If we want to find a stock that could multiply in the long term, what underlying trends should we look for? First, we want to find a growing return on the capital employed (ROCE) and then alongside it an ever increasing base of the capital employed. Ultimately, this shows that this is a company that reinvests profits with increasing returns. Although, as we looked Forval (TSE:8275) didn’t seem to check all of those boxes.

What is return on capital employed (ROCE)?

If you’ve never worked with ROCE before, it measures the “return” (profit before tax) that a company generates on the capital employed in its business. The formula for this calculation at Forval is:

Return on capital = earnings before interest and taxes (EBIT) ÷ (total assets – current liabilities)

0.14 = JP¥3.3 billion ÷ (JP¥41 billion – JP¥17 billion) (Based on the last twelve months to March 2024).

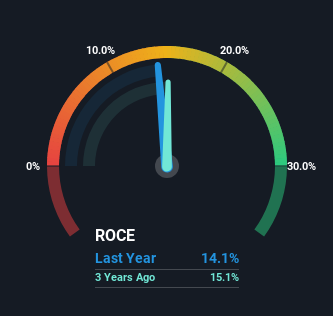

Therefore, Forval has a ROCE of 14%. In absolute terms, this is a satisfactory return, but compared to the electronics industry average of 9.4%, it is significantly better.

Check out our latest analysis for Forval

While the past is not representative of the future, it can be helpful to know a company’s historical performance, which is why we created the chart above. If you’re interested in further investigating Forval’s past, check out this free Chart showing Forval’s historical earnings, revenue and cash flow.

What does the ROCE trend tell us for Forval?

On the surface, Forval’s ROE trend does not inspire confidence. Around five years ago, ROE was 22%, but it has since fallen to 14%. However, it looks like Forval is reinvesting for long-term growth because, although capital employed has increased, the company’s revenues have barely changed over the past 12 months. It’s worth keeping an eye on the company’s earnings from now on to see if these investments actually end up contributing to the bottom line.

On a related note, Forval has reduced its current liabilities to 42% of total assets. This may partially explain why ROCE has fallen. In addition, this may reduce some aspects of business risk, as the company’s suppliers or short-term creditors are now funding less of its operations. Since the company is essentially funding more of its operations with its own money, one could argue that this has made the company less efficient at generating ROCE. Keep in mind that 42% is still quite a lot, so these risks are still relatively present.

The most important things to take away

In summary, Forval is investing funds in the company to grow, but unfortunately, it looks like revenues haven’t grown much so far. With the stock up an impressive 61% over the past five years, investors must expect more to come. If the underlying trends continue, we wouldn’t expect the company to become a multibagger in the future.

However, Forval carries some risks and we have found 1 warning sign for Forval that might interest you.

While Forval may not be generating the highest returns right now, we have compiled a list of companies that are currently generating more than 25% return on equity. Check it out free List here.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.