For beginners, it can be a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it doesn’t currently have a track record of revenue and profit. Sometimes these stories can cloud investors’ minds and cause them to invest based on their emotions rather than the company’s strong fundamentals. A loss-making company has yet to prove itself with profits, and at some point the inflow of outside capital may dry up.

Although we are in the era of high-sky investing in technology stocks, many investors still follow a more traditional strategy. They buy shares of profitable companies such as MOBI Industry (TADAWUL:9517). While this does not mean that the company is the best investment opportunity ever, profitability is a key component of business success.

Check out our latest analysis for the MOBI industry

How quickly is the MOBI industry growing earnings per share?

If you believe that markets are even remotely efficient, then over the long term you would expect a company’s share price to follow its earnings per share (EPS). This means that EPS growth is viewed as a real positive by most successful long-term investors. Shareholders will be pleased to hear that MOBI Industry’s EPS has grown 20% annually over three years. If the company can sustain this growth, we expect shareholders to be pleased.

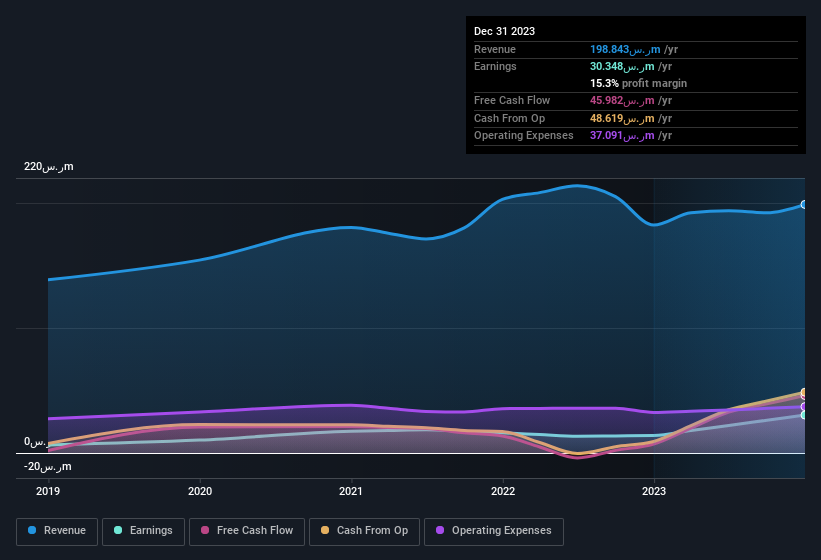

It’s often helpful to look at earnings before interest and tax (EBIT) margins and revenue growth to get another sense of the quality of the company’s growth. The good news is that MOBI Industry is growing its revenue and EBIT margins have improved by 7.7 percentage points to 15% over the last year. That’s great to see on both counts.

In the graph below you can see how the company has grown profit and revenue over time. Click on the graph to see the actual numbers.

MOBI Industry is not a huge company, with a market capitalization of Algeria $610 million, so it is particularly important to examine the strength of its balance sheet.

Are the insiders of the MOBI industry on the same page as all shareholders?

Many consider high insider ownership to be a strong sign of alignment between a company’s leaders and ordinary shareholders. Therefore, we’re pleased to report that MOBI Industry insiders own a significant stake in the company. With 46% of the company, insiders have a lot of influence over share price movements. This should be a positive sign for investors as it suggests that decision makers are also influenced by their decisions. To give you an idea, the value of insiders’ shares in the company is estimated to be ر.س281 million at the current share price. That should be more than enough to keep them focused on creating shareholder value!

Is it worth keeping an eye on the MOBI industry?

There’s no denying that MOBI Industry has been growing its earnings per share at a very impressive rate. That’s attractive. Moreover, the high level of insider ownership is impressive and suggests that management values EPS growth and has confidence in MOBI Industry’s continued strength. The bottom line is that solid EPS growth and company insiders aligned with shareholders point to a company worthy of further investigation. Don’t forget that there may still be risks. For example, we’ve identified: 1 warning sign for the MOBI industry that you should know.

While MOBI Industry certainly looks good, it could be attractive to more investors if insiders were to snap up shares. If you like to see companies that have more ownership, then check out this handpicked selection of Saudi companies that not only boast strong growth but also have strong insider support.

Please note that the insider transactions discussed in this article are reportable transactions in the respective jurisdiction.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.