Even if this is not enough for some shareholders, we believe it is good Northwest Natural Holdings GmbH (NYSE:NWN) stock price rose 14% in a single quarter. But that doesn’t change the fact that the returns over the past five years have been anything but encouraging. In fact, the stock price has fallen 44%, which is far below the return you could get by buying an index fund.

While the last five years have been rough for Northwest Natural Holding shareholders, the last week has shown promising signs. So let’s take a look at the fundamentals over the long term and see if they were the reason for the negative returns.

View our latest analysis for Northwest Natural Holding

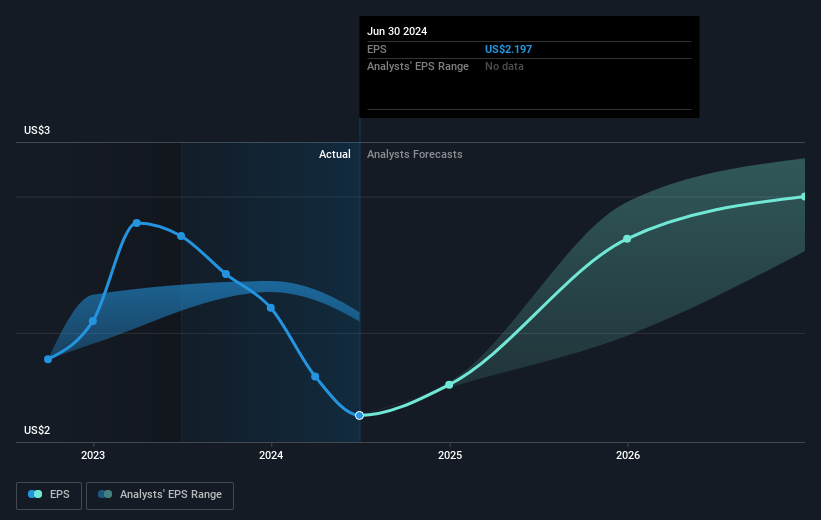

In his essay The super investors of Graham and Doddsville Warren Buffett described how stock prices do not always rationally reflect the value of a company. One way to examine how market sentiment has changed over time is to look at the interaction between a company’s stock price and its earnings per share (EPS).

During the five years that the share price fell, Northwest Natural Holding’s earnings per share (EPS) fell by 2.9% each year. Readers should note that the share price fell faster than EPS during this period, at 11% per year. So it seems that the market has had too much faith in the company in the past.

Below you can see how EPS has changed over time (click on the image to see the exact values).

It might be worth taking a look at our free Northwest Natural Holdings earnings, revenue and cash flow report.

What about dividends?

It’s important to consider both the total shareholder return and the share price return for any stock. The TSR includes the value of any spin-offs or discounted capital raisings, plus any dividends, based on the assumption that the dividends are reinvested. So, for companies that pay a generous dividend, the TSR is often much higher than the share price return. In the case of Northwest Natural Holding, the TSR over the last 5 years is -31%. That exceeds the share price return we mentioned earlier. This is largely due to the dividend payments!

A different perspective

Northwest Natural Holding shareholders have seen a gain of 6.8% for the year (even including dividends). But this return is below market value. On the positive side, this is still a gain, and certainly better than the annual loss of around 6% that has been accumulating over half a decade. It could well be that the business is stabilising. While it is certainly worth considering the varying impacts of market conditions on the share price, there are other factors that are even more important. Nevertheless, it is important to be aware that Northwest Natural Holding 3 warning signals in our investment analysis and one of them is a bit uncomfortable…

If you would rather check out another company — one with potentially better financials — then don’t miss this free List of companies that have proven their ability to increase their earnings.

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks currently trading on U.S. exchanges.

Valuation is complex, but we are here to simplify it.

Discover whether Northwest Natural Holding could be under- or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.