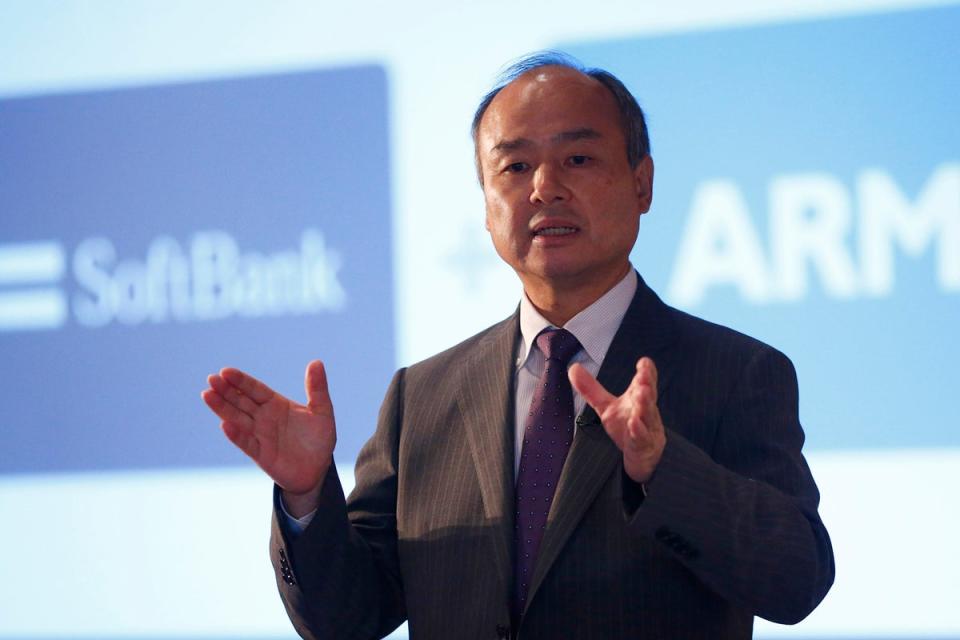

SoftBank Group Corp.’s boastful founder Masayoshi Son is back, this time with plans to usher in an age of artificial superintelligence.

Son outlined his ambitions to create an AI a thousand times more intelligent than any human, making his grandest announcements since the Japanese conglomerate took steps to repair its finances after a series of ill-timed bets on startups. Sounding both more energetic and thoughtful than he has in years, Son spoke Friday of a future in which Arm Holdings’ chips support a thriving ecosystem of robots and powerful data centers that can collectively cure cancer, clean houses and play with children.

Son, visibly overcome with emotion at times, spoke about how he wanted to change the world before leaving it forever. Invoking his late friend Steve Jobs, the 66-year-old said their frequent conversations often left him in tears as he realized his legacy would pale in comparison to that of the Apple Inc. co-founder. But after racking his brain over his next move over the past year, which saw Son’s father die, the billionaire said he woke up Friday morning with an epiphany.

“I have my answer,” Son told shareholders gathered at an annual general meeting. “This is what I was born to do,” he said, without elaborating on what his next plans might be. “We have done many things, but all of this was just a prelude to my dream of making ASI a reality.”

SoftBank shares fell 3.1 percent, the biggest drop in three months. SoftBank is working on a plan to invest about $100 billion in AI chips under a project called Izanagi, Bloomberg reported in February. When a shareholder asked about Izanagi, Son said he was determined to deliver results and would work hard to achieve his goals, without elaborating.

Son’s statements and goals have become even more grandiose relative to SoftBank’s share price, which has benefited from Arm’s AI-driven rally in 2024, and its cash holdings. He brushed aside questions about share buybacks, dividends and stock splits, saying such matters are of little importance compared to realizing a world powered by superintelligence and the evolution of humanity.

“Share buybacks, dividend payouts – these are minor things,” Son said, adding that the development and spread of technology will increase value for shareholders. “You may be worried about whether SoftBank shares will rise or not. Let’s forget about such things. Does it really matter? Masayoshi Son has a dream he wants to pursue – please keep your fingers crossed for me.”

Son’s stance on share buybacks follows Elliott Investment Management’s recent purchase of over $2 billion worth of SoftBank shares and call for a $15 billion share buyback. This is the second time Elliott has targeted SoftBank.

“You never know what will happen and I’m not making any promises. Maybe I’ll do a share buyback, maybe I’ll decide to take the company private, or maybe I’ll continue doing business as usual,” Son said. “Whatever form it takes, I’ll pursue ASI.”

Top executives have indicated the company is preparing to go on the offensive with investments, potentially ending a multi-quarter pause. The company’s loan-to-value ratio fell to 8.4% by the end of March, near a record low and well below the company’s 25% target, one of Son’s preferred yardsticks for determining whether the company is properly balancing risks and rewards.

SoftBank’s net asset value hit 34 trillion yen ($214 billion) on Thursday, buoyed by Arm’s surge. SoftBank’s own shares have risen nearly 60 percent this year and are poised to hit a new record.

Chief Financial Officer Yoshimitsu Goto told investors during an earnings call last month that SoftBank is now in a position where it needs to take on greater risks, particularly given the accelerated development of artificial intelligence.

“The biggest risk for us is not taking risks,” said Goto, who previously served as a voice of reason for the risk-taking son. “We have a number of challenges in mind.”