Corning Incorporated (NYSE:GLW) will trade ex-dividend for the next 4 days. The ex-dividend date is usually one business day before the record date, which is the date by which you, as a shareholder, must be on record in the company’s books to receive the dividend. The ex-dividend date is important because the settlement process takes two full business days, so if you miss this day, you won’t appear on the company’s books on the record date. This means you must purchase Corning shares before August 30th to receive the dividend, which will be paid on September 27th.

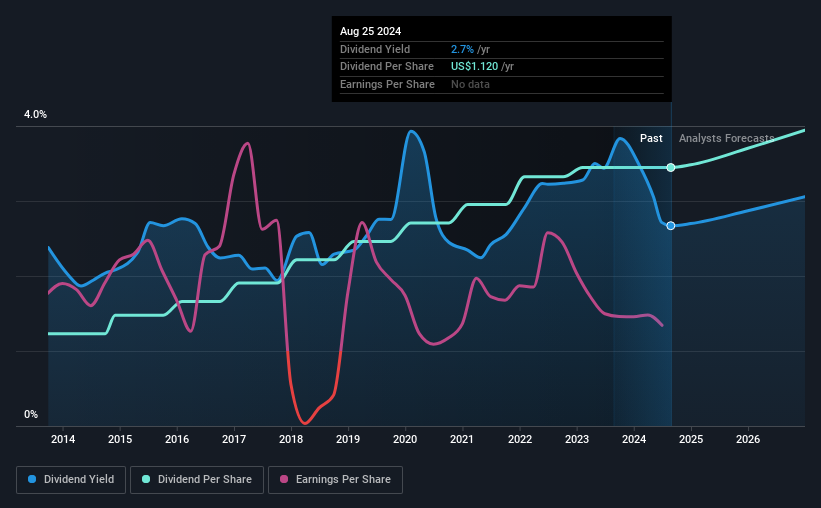

The company’s next dividend payment will be $0.28 per share, after the company paid out a total of $1.12 to shareholders last year. Based on last year’s payments, Corning stock has a yield of around 2.7% on the current share price of $41.94. If you are buying this company for its dividend, you should have an idea of whether Corning’s dividend is reliable and sustainable. Therefore, readers should always check whether Corning has been able to grow its dividend, or if the dividend is at risk of being cut.

Check out our latest analysis for Corning

Dividends are typically paid out of company earnings. If a company pays more in dividends than it earned in profit, the dividend may be unsustainable. Corning paid out a worryingly high 218% of its profit as dividends last year, which makes us worry that there is something about this business we don’t fully understand. A useful second check can be to evaluate whether Corning generated enough free cash flow to afford the dividend. The company paid out 105% of its free cash flow last year, which we think is outside the ideal range for most companies. Companies typically need more cash than profits – expenses don’t cover themselves – so it’s not nice to see the company paying out so much of its cash flow.

From a dividend perspective, cash is slightly more important than profit. However, since Corning’s payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

Click here to see the company’s payout ratio as well as analyst estimates of its future dividends.

Have earnings and dividends increased?

Companies with declining profits are tricky from a dividend perspective. Investors love dividends, so when profits fall and the dividend is cut, expect the stock to be massively sold off at the same time. Corning’s earnings per share have fallen by about 16% annually over the past five years. When earnings per share fall, the maximum dividend that can be paid also falls.

Another important way to gauge a company’s dividend prospects is to measure its historical dividend growth rate. Over the past 10 years, Corning has increased its dividend by an average of about 11% per year. The only way to pay higher dividends when earnings are shrinking is to either pay out a larger percentage of earnings, spend cash from the balance sheet, or borrow the money. Corning already pays out 218% of its earnings, and with earnings shrinking, we think it’s unlikely that this dividend will grow quickly in the future.

To sum it up

Does Corning have what it takes to maintain its dividend payments? It looks like an unattractive opportunity, with earnings per share declining while paying out an uncomfortably high percentage of both earnings (218%) and cash flow as dividends. This is a highly negative combination that often suggests the company could take a dividend cut in the near future. Overall, it doesn’t look like the most suitable dividend stock for a long-term buy-and-hold investor.

However, if you are still interested in Corning and want to learn more, it will be very helpful for you to know what risks are associated with this stock. We have identified 4 warning signs with Corning (at least 1, which is important), and understanding them should be part of your investment process.

In general, we would not recommend simply buying the first dividend stock you see. Here is a curated list of interesting stocks with high dividend numbers.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.