Wuhan DR Laser Technology Corp., Ltd. (SZSE:300776) has failed to surge after announcing some good earnings. We believe investors may be concerned about some underlying factors.

Check out our latest analysis for Wuhan DR Laser TechnologyLtd

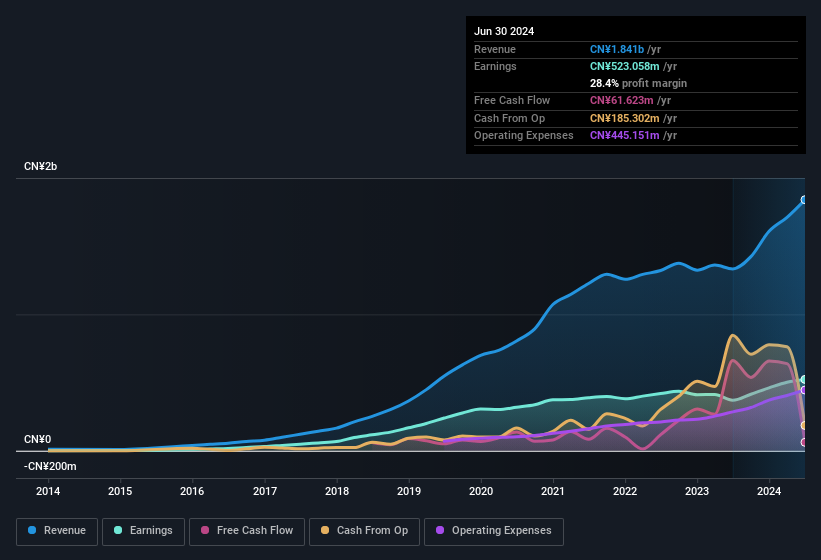

Looking at cash flow versus earnings for Wuhan DR Laser Technology Ltd.

An important financial metric used to measure how well a company converts its profit into free cash flow (FCF) is the Delimitation ratio. Simply put, this metric subtracts FCF from net income and divides that number by the company’s average funds from operations during that period. This metric indicates how much of a company’s profit is not covered by free cash flow.

Therefore, it is actually considered good if a company has a negative accrual ratio, but bad if its accrual ratio is positive. While it is not a problem to have a positive accrual ratio, indicating some level of non-cash profits, a high accrual ratio is arguably a bad thing because it indicates that there is no cash flow to match accounting profits. This is because some academic studies have pointed out that high accrual ratios tend to lead to lower profits or lower profit growth.

Wuhan DR Laser Technology Ltd has an accrual ratio of 0.46 for the year to June 2024. That means it didn’t generate nearly enough free cash flow to offset its profit. Generally speaking, that doesn’t bode well for future profitability. That said, it generated free cash flow of CNY62m during that period, way below its reported profit of CNY523.1m. Wuhan DR Laser Technology Ltd’s free cash flow actually declined last year, but it could rebound next year as free cash flow is often more volatile than accounting profit. On a positive note for Wuhan DR Laser Technology Ltd shareholders, the accrual ratio was significantly better last year, giving reason to believe the company could return to stronger cash conversion in the future. Shareholders should expect improved cash flow to profit in the current year, if that indeed occurs.

You may be wondering what analysts are predicting in terms of future profitability. Fortunately, you can click here to see an interactive chart depicting future profitability based on their estimates.

Our assessment of the earnings development of Wuhan DR Laser Technology Ltd.

As we discussed above, we believe Wuhan DR Laser Technology Ltd.’s earnings were not supported by free cash flow, which may worry some investors. As a result, we think it’s quite possible that Wuhan DR Laser Technology Ltd.’s underlying earnings power is lower than its statutory profit. Still, it’s worth noting that its earnings per share are up 33% over the past three years. Ultimately, it’s important to consider more than just the factors mentioned above if you want to properly understand the company. If you want to learn more about Wuhan DR Laser Technology Ltd. as a company, it’s important to be aware of any risks it faces. For example, we found that Wuhan DR Laser Technology Ltd. 2 warning signs (1 we don’t like so much!) that deserve your attention before you continue with your analysis.

This note only examined a single factor that can provide insight into the nature of Wuhan DR Laser Technology Ltd.’s earnings. However, there are many other ways to form an opinion about a company. For example, many people consider a high return on equity to indicate a favorable business situation, while others like to “follow the money” and look for stocks that insiders are buying. You may want to look here. free Collection of companies with high return on equity or this list of stocks with high insider ownership.

Valuation is complex, but we are here to simplify it.

Discover if Wuhan DR Laser TechnologyLtd could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.