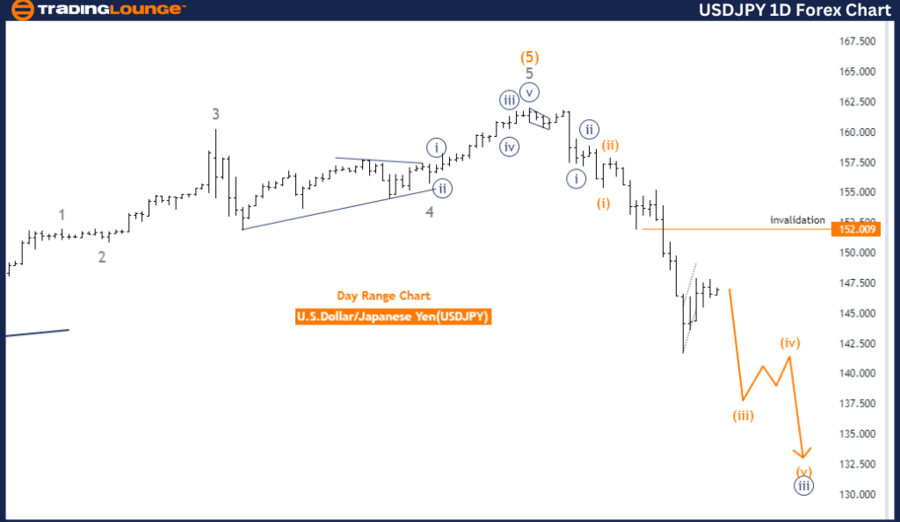

USD/JPY Elliott Wave Analysis, Trading Lounge Daily Chart.

Daily chart US Dollar/Japanese Yen (USD/JPY).

USD/JPY Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Orange Wave 3.

Position: Navy blue wave 3.

Towards the next higher grades: Orange Wave 4.

Details: The orange wave 2 seems to be completed, now the orange wave 3 is active.

Invalid wave termination level: 152,009.

The USD/JPY Elliott Wave analysis on the daily chart shows a distinct trend defined by an impulsive mode with the orange wave 3 as the primary structure. This indicates that the market is currently undergoing a significant uptrend within the Elliott Wave framework.

The market is within the navy blue wave 3, which is part of the broader orange wave 3. This suggests that a strong and sustained uptrend is underway. According to Elliott Wave Theory, wave 3 is generally the strongest and longest wave in an impulse sequence, meaning the current trend is likely to continue with considerable momentum.

The direction for the next higher degrees points to the upcoming orange wave 4. This suggests that after the current orange wave 3 is completed, the market could enter a corrective phase leading to orange wave 4. For now, the focus remains on the continuation of the uptrend within orange wave 3.

The analysis shows that orange wave 2 has completed. This marks the end of a corrective phase and the beginning of the next impulse wave, orange wave 3. The transition from orange wave 2 to orange wave 3 is crucial as it signals the beginning of a new, stronger phase of the market’s uptrend.

The invalid wave cancellation level is at 152,009. This level is crucial for confirming the current wave structure. If the market falls below this level, it would invalidate the current analysis, suggesting that the expected upside move within the orange wave 3 does not materialize as expected. In such a case, a reassessment of the wave count and overall market direction would be necessary.

Summary:

USD/JPY Elliott wave analysis on the daily chart indicates a strong uptrend within an impulsive wave structure. The market is currently moving forward in the dark blue wave 3 within the orange wave 3 after completing the orange wave 2. The invalid wave cancellation level at 152.009 is key to maintaining this bullish outlook.

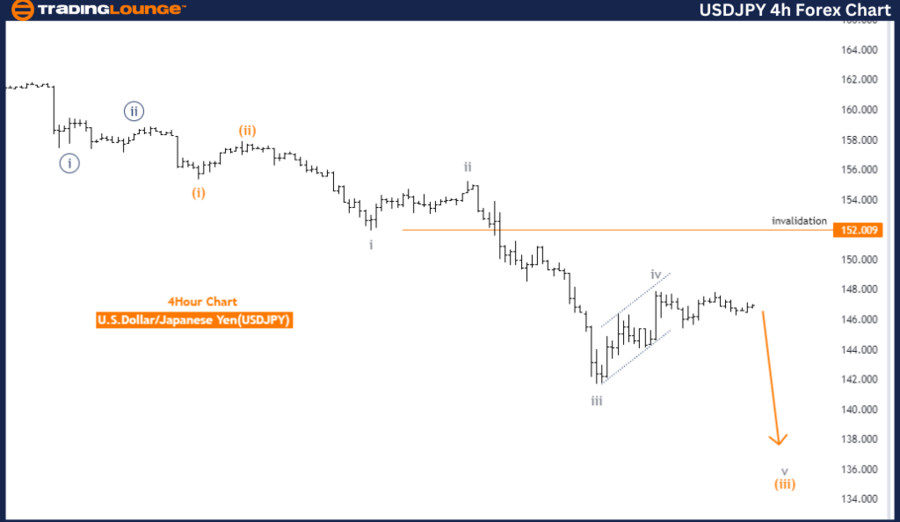

4-hour chart of US Dollar/Japanese Yen (USD/JPY).

USD/JPY Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Gray Wave 5.

Position: Orange Wave 3.

Towards the next higher grades: Orange Wave 4.

Details: Graywave 4 appears to be complete; graywave 5 is now active.

Invalid wave termination level: 152,009.

The USD/JPY Elliott Wave analysis on the 4-hour chart indicates a strong trend characterized by an impulsive mode. The primary wave structure of the analysis is the grey wave 5, which suggests that the market is in the final stages of a larger upmove within the Elliott Wave framework.

Currently, the market is within the orange wave 3. This placement highlights that the market is advancing in the third wave of the larger gray wave 5, which is typically the strongest and most extended wave in an impulse structure. The direction for the next higher degrees points to the upcoming orange wave 4, suggesting that a corrective phase could begin after the current wave is complete.

The analysis shows that grey wave 4 appears to have completed. This marks the end of a corrective phase within the ongoing uptrend and sets the stage for the development of grey wave 5. The transition to grey wave 5 is significant as it represents the final push of the current trend, with the market expected to maintain its uptrend momentum until this wave ends.

The invalid wave cancellation level is at 152,009. This level is crucial for confirming the current wave structure. If the market falls below this level, it would invalidate the present analysis, suggesting that the expected upside movement within the gray wave 5 is not developing as expected. In such a case, a reassessment of the wave count and the general market direction would be necessary.

Summary:

USD/JPY Elliott wave analysis on the 4-hour chart indicates a continued uptrend within an impulsive wave structure. The market is currently trading in the orange wave 3 within the grey wave 5 after the completion of the grey wave 4. The invalid wave cancellation level at 152.009 is key to maintaining the validity of this bullish forecast.

Technical Analyst: Malik Awais.

:max_bytes(150000):strip_icc():focal(749x0:751x2)/phil-donahue-phil-donahue-081924-tout-818c06d114404c2d9acf72f81c6f9e37.jpg)