Cinemark Holdings, Inc. (NYSE:CNK) shares have continued their recent run, gaining 26% in the last month alone. Looking back a little further, it’s encouraging to see that the stock is up 62% in the last year.

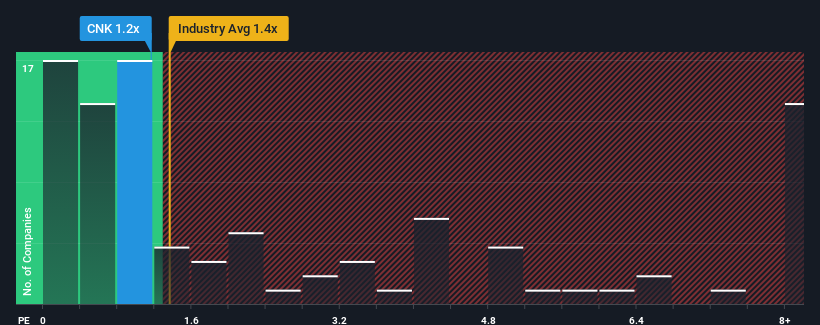

Although the price has risen sharply, it is not an exaggeration to say that Cinemark Holdings’ price-to-sales (or “P/S”) ratio of 1.2 seems fairly “average” right now, compared to the entertainment industry in the United States, where the median P/S ratio is around 1.4. While this may not be surprising, if the P/S ratio is not justified, investors could miss out on a potential opportunity or ignore an impending disappointment.

Check out our latest analysis for Cinemark Holdings

How Cinemark Holdings has developed

With revenue growth that has lagged behind most other companies recently, Cinemark Holdings has been relatively sluggish. Many may expect the uninspiring revenue trend to turn positive, which has prevented a decline in the P/S ratio. One would really hope so, otherwise one is paying a relatively high price for a company with this growth profile.

Do you want the full picture of analyst estimates for the company? Then our free The Cinemark Holdings report will help you find out what’s on the horizon.

How is Cinemark Holdings’ revenue growth developing?

To justify its price-to-sales ratio, Cinemark Holdings would need to achieve industry-standard growth.

First, if we look back, we see that the company barely posted any significant revenue growth over the past year. Spectacularly, revenue growth has increased several fold over the past three years, even though the last 12 months have been nothing special. Accordingly, shareholders will be pleased, but will also have some serious questions about the last 12 months to ponder.

Looking ahead, estimates from the ten analysts covering the company suggest that revenue will grow by 10% next year. With the industry forecast to grow by 12%, the company is poised to post comparable revenue results.

With this information, we can see why Cinemark Holdings is trading at a fairly similar price-to-earnings ratio to the industry. It seems that most investors expect average future growth and are only willing to pay a moderate amount for the stock.

The last word

Cinemark Holdings stock has gained a lot of momentum recently, which has brought its price-to-sales ratio in line with the rest of the industry. We would say that the price-to-sales ratio is not primarily used as a valuation tool, but rather to gauge current investor sentiment and future expectations.

We have seen Cinemark Holdings maintain a reasonable price-to-earnings ratio as its revenue growth numbers are in line with the rest of the industry. At this point, investors believe that the potential for revenue improvement or deterioration is not large enough to drive the price-to-earnings ratio up or down. Unless these conditions change, they will continue to support the share price at these levels.

Don’t forget that there may be other risks as well. For example, we have found 2 warning signs for Cinemark Holdings (1 means potentially serious) What you should know.

If you uncertain about the strength of Cinemark Holdings’ businesswhy not explore our interactive stock list with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.