The recent market correction was nothing compared to what has happened in the past. Here are the five biggest asset bubbles of all time – a reminder that market crashes are inevitable, but that history can give you perspective and emotional resilience you wouldn’t otherwise have, advises Gav BlaxbergCEO of Wolf Financial.

1. Tulip mania. Nothing of such little use has skyrocketed in price like tulips did in 1637. At the height of the bubble, tulips sold for the same price as luxury homes. Their rarity, combined with the desire of rich people to own them, caused this bubble.

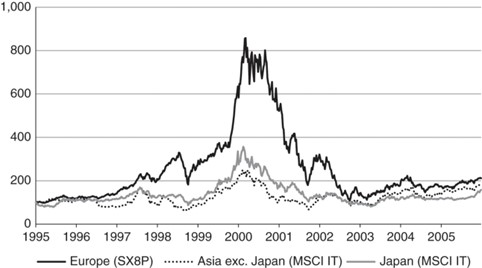

2. Dotcom bubble. The hype around the Internet was huge at its peak. From 1995 to 2000, the Nasdaq Composite Index rose 800%. It then fell 78% from its market peak in 2000.

3.Japanese 1989. Thanks to economic growth and low interest rates, Japanese real estate and stock prices rose sharply. At its peak, the Japanese Imperial Palace was worth more than all the real estate in California. Many consider this the biggest bubble of all time. To this day, some asset prices have not recovered.

4. Great Recession. Zero percent down payments and subprime mortgages drove up American home prices. From the late 1990s to the peak in 2006, home prices doubled on average. When it all came crashing down, 2.9 million homes were in foreclosure—the highest number ever recorded.

5. The big crash. In the “Roaring Twenties” a speculative bubble arose that reached its peak in September 1929. Adjusted for inflation, stock prices rose almost sevenfold over the course of the decade. It was one of the biggest bubbles of all time – and its bursting contributed to the Great Depression.

Read about past booms and busts to prepare. There’s no better investment than the space between your ears.

Subscribe to the Wolf Financial newsletter here…