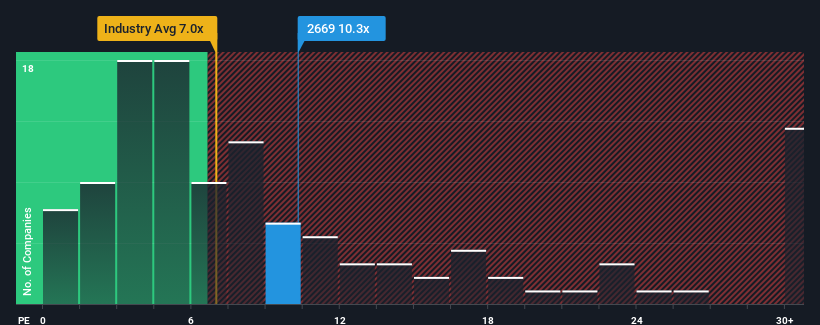

There are not many who think The (HKG:2669) price-to-earnings ratio (or “P/E”) of 10.3 is worth mentioning when the median P/E in Hong Kong is similarly high at around 9. However, it is not advisable to simply ignore the P/E without explanation as investors may miss a special opportunity or make a costly mistake.

With earnings growth that has been better than most companies recently, China Overseas Property Holdings has done relatively well. It could be that many expect the strong earnings performance to fade, which has prevented the P/E ratio from rising. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for China Overseas Property Holdings

If you want to know what analysts are predicting for the future, you should check out our free Report on China Overseas Property Holdings.

Does the growth correspond to the P/E ratio?

There is a fundamental assumption that a company should adjust to the market for P/E ratios like that of China Overseas Property Holdings to be considered reasonable.

Looking back, the last year has seen an exceptional 23% increase in earnings for the company. Encouragingly, earnings per share have also increased by 128% year-on-year overall, driven by growth over the last 12 months. So it’s fair to say that the company’s earnings growth has been outstanding recently.

Looking ahead, analysts covering the company expect earnings to grow 15% per year over the next three years, roughly in line with the 15% per year growth forecast for the overall market.

With this information, we can see why China Overseas Property Holdings is trading at a fairly similar P/E to the market. It seems that most investors expect average future growth and are only willing to pay a moderate amount for the stock.

The last word

It is argued that the price-to-earnings ratio is not a good measure of value in certain industries, but can be a meaningful indicator of business sentiment.

We found that China Overseas Property Holdings maintains its modest P/E ratio because its forecast growth is in line with the wider market, as expected. Currently, shareholders are happy with the P/E ratio because they are fairly confident that future earnings will not hold any surprises. Under these circumstances, it is difficult to imagine the share price moving much in one direction or the other in the near future.

Many other important risk factors can be found in the company’s balance sheet. Take a look at our free Balance sheet analysis for China Overseas Property Holdings with six simple checks of some of these key factors.

Naturally, If you take a closer look at some good candidates, you may come across a fantastic investment. So take a look at the free List of companies with a strong growth track record and a low P/E ratio.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.