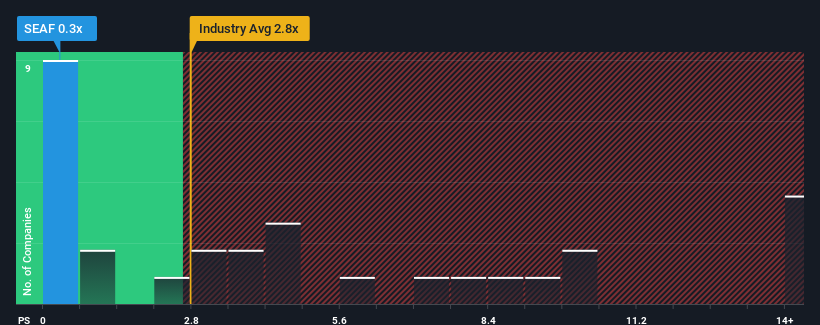

With a price-to-sales ratio (or “P/S”) of 0.3x Seafire AB (publ) (STO:SEAF) may be sending very bullish signals right now, as almost half of all capital market companies in Sweden have a P/S ratio above 2.8x, and even P/S values above 9x are not uncommon. However, the P/S might be quite low for a reason and further research is needed to determine if this is justified.

Check out our latest analysis for Seafire

How has Seafire developed recently?

We must say that Seafire’s revenue was not impressive last year without any noticeable growth. Perhaps the market believes that the recent weak revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. If not, existing shareholders may be optimistic about the future direction of the share price.

Although there are no analyst estimates for Seafire, take a look at these free Data-rich visualization to see how the company is performing in terms of profit, revenue and cash flow.

Is Seafire forecast to grow revenue?

Seafire’s price-to-sales ratio is typical of a company that is expected to have very low growth or even declining sales and, more importantly, is performing significantly worse than the industry average.

If we look at last year’s revenue result, the company has produced a result that is barely different from the previous year. Nevertheless, the company has recorded an excellent total revenue increase of 284% over the last three-year period, despite the uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions about the last 12 months.

Compared to the industry’s one-year growth forecast of 17%, the recent medium-term sales trend is much more tempting

Given this information, we find it odd that Seafire is trading at a lower price-to-earnings ratio than the industry average. Apparently, some shareholders believe that recent performance has exceeded their limits and have accepted significantly lower selling prices.

What can we learn from Seafire’s P/S?

It is argued that the price-to-sales ratio is not a good measure of value in certain industries, but can be a meaningful indicator of business sentiment.

We are very surprised that Seafire is currently trading at a much lower price-to-earnings ratio than expected, given that recent growth over the past three years is higher than the industry forecast. When we see strong revenues with above-industry growth, we believe there are significant underlying risks to the company’s ability to make money, putting downward pressure on the price-to-earnings ratio. While recent revenue trends over the past medium term suggest the risk of a price decline is low, investors seem to recognize the likelihood of future revenue volatility.

Please note, however, Seafire shows 2 warning signals in our investment analysis, and one of them is causing some concern.

Naturally, Profitable companies with a history of strong earnings growth are generally safer bets. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.