A lackluster earnings announcement from Create Medic Co., Ltd. (TSE:5187) didn’t send its share price lower last week, but we believe investors should be aware of some underlying factors that could be a cause for concern.

Check out our latest analysis for Create Medic

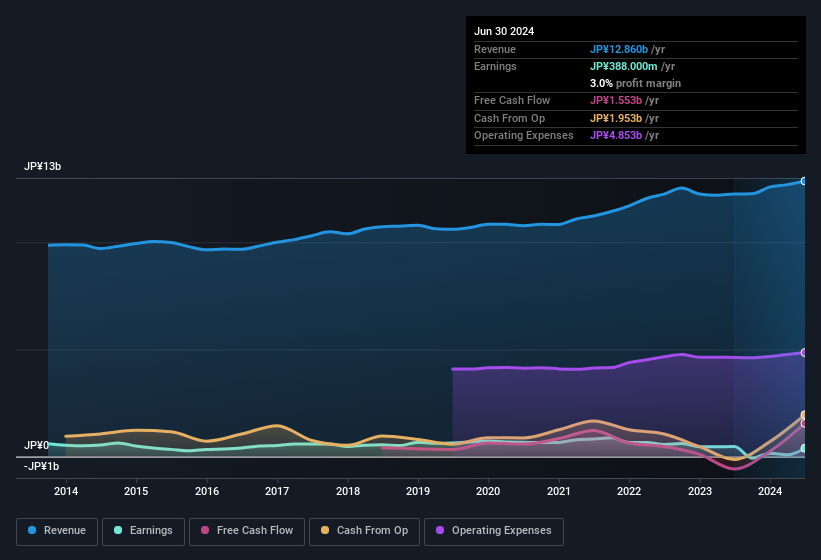

A closer look at Create Medic’s revenue

In high finance, the most important metric that measures how well a company converts reported earnings into free cash flow (FCF) is the Delimitation ratio (from cash flow). Simply put, this ratio subtracts FCF from net income and divides that number by the company’s average funds from operations during that period. The ratio tells us how much a company’s profit exceeds its FCF.

Therefore, it is actually considered good if a company has a negative accrual ratio, but bad if its accrual ratio is positive. This is not to say that we should be concerned about a positive accrual ratio, but it is worth noting when the accrual ratio is quite high. To quote a 2014 paper by Lewellen and Resutek, “Companies with higher accruals tend to be less profitable in the future.”

For the twelve months to June 2024, Create Medic recorded an accrual ratio of -0.10. This means that the company has good cash conversion, and that its free cash flow comfortably exceeded its profit over the last year. In fact, it had free cash flow of JP¥1.6bn last year, which was a lot more than its statutory profit of JP¥388.0m. Considering that Create Medic had negative free cash flow in the corresponding period last year, the trailing twelve months result of JP¥1.6bn seems to be a step in the right direction. That’s not all there is to consider, however. We can see that unusual items have affected its statutory profit, and therefore its accrual ratio.

Note: We always recommend investors check balance sheet strength. Click here to access our balance sheet analysis of Create Medic.

How do unusual items affect profits?

Surprisingly, although the accrual ratio implied strong cash conversion, Create Medic’s accounting profit was actually boosted by unusual items of JP¥395 million. While it’s always nice to have a higher profit, sometimes a large contribution from unusual items dampens our enthusiasm. When we analyzed the numbers of thousands of listed companies, we found that an increase from unusual items in a given year is often not repeated next year. Which is hardly surprising given the name. Create Medic had a fairly significant contribution from unusual items relative to its profit to June 2024. All else being equal, this would likely result in statutory profit not being a good indicator of underlying earnings power.

Our assessment of Create Medic’s earnings development

To sum up, Create Medic’s accrual ratio suggests that statutory profits are of good quality, but on the other hand, profits have been boosted by unusual items. Taking these factors into account, we don’t think Create Medic’s statutory profits paint too harsh a picture of the company. Remember that when analyzing a stock, it’s important to note the risks associated with it. For example, we’ve identified: 3 warning signs for Create Medic (1 we don’t like so much) that you should know.

In this article, we’ve looked at a number of factors that can affect the usefulness of earnings numbers as a guide to a company. However, there are many other ways to form an opinion about a company. For example, many people view a high return on equity as an indication of a favorable business situation, while others like to “follow the money” and look for stocks that insiders are buying. Although this may require a little research, you may find free Collection of companies with high return on equity or this list of stocks with significant insider holdings may prove useful.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.