The share price did not rise after Wah Lee Industrial Corporation (TWSE:3010) posted decent gains last week. Our analysis shows that there are some worrying factors in the earnings that may cause investors to worry.

Check out our latest analysis for Wah Lee Industrial

To understand the value of a company’s earnings growth, it’s essential to consider any dilution to shareholders’ shares. In fact, Wah Lee Industrial increased the number of shares in issue by 6.2% over the last twelve months by issuing new shares. As a result, net income is now split between a larger number of shares. Celebrating net income while ignoring dilution is like being happy because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Wah Lee Industrial’s earnings per share by clicking here.

A look at the impact of Wah Lee Industrial’s dilution on earnings per share (EPS)

Unfortunately, Wah Lee Industrial’s earnings have fallen by 7.1% per year over the past three years. On the positive side, earnings have grown by 5.5% over the past twelve months. However, earnings per share have been less impressive, growing by just 2.9% over that time, so dilution has a significant impact on shareholder returns.

Changes in share price tend to reflect changes in earnings per share over the long term, so it would certainly be positive for shareholders if Wah Lee Industrial could grow earnings per share on a consistent basis. On the other hand, we would be far less enthusiastic if we were told that earnings (but not earnings per share) were improving. For the average retail shareholder, earnings per share is a good yardstick to check their hypothetical “share” of the company’s profits.

You may be wondering what analysts are predicting in terms of future profitability. Fortunately, you can click here to see an interactive chart depicting future profitability based on their estimates.

Our assessment of Wah Lee Industrial’s earnings performance

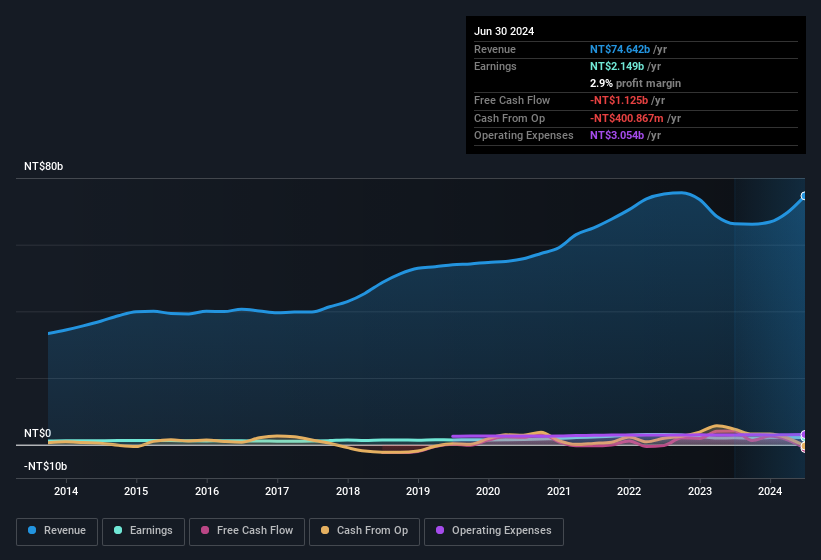

Due to the dilution of existing shareholders, each Wah Lee Industrial share now receives a significantly smaller share of the total profit. Therefore, it seems possible to us that Wah Lee Industrial’s true underlying earnings power is actually less than its statutory profit. The good news is that earnings per share have increased slightly over the last year. Of course, we have only scratched the surface when analyzing profit; one could also consider margins, forecast growth and return on capital, among other things. So if you want to dig deeper into this stock, it is important to consider all the risks it faces. In our analysis, we found that Wah Lee Industrial 2 warning signs and it would be unwise to ignore them.

Today we’ve focused on a single data point to better understand the nature of Wah Lee Industrial’s earnings. But there’s always more to discover if you can dig into the details. For example, many people consider a high return on equity to indicate a favorable business situation, while others like to “follow the money” and look for stocks that insiders are buying. You might want to check this out. free Collection of companies with high return on equity or this list of stocks with high insider ownership.

Valuation is complex, but we are here to simplify it.

Find out if Wah Lee Industrial could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.