Ningbo Henghe Precision Industry Co., Ltd. (SZSE:300539) Shareholders will be pleased to see that the share price has risen by 11% in the past month. But that is only minimal compensation for the share price’s underperformance over the past year. After all, the share price has fallen by 30% over the past year, significantly underperforming the market.

On a more positive note, the company has increased its market capitalization by CNY 182 million in the last seven days alone. So let’s see if we can find out the reason behind the annual loss for shareholders.

Check out our latest analysis for Ningbo Henghe Precision IndustryLtd

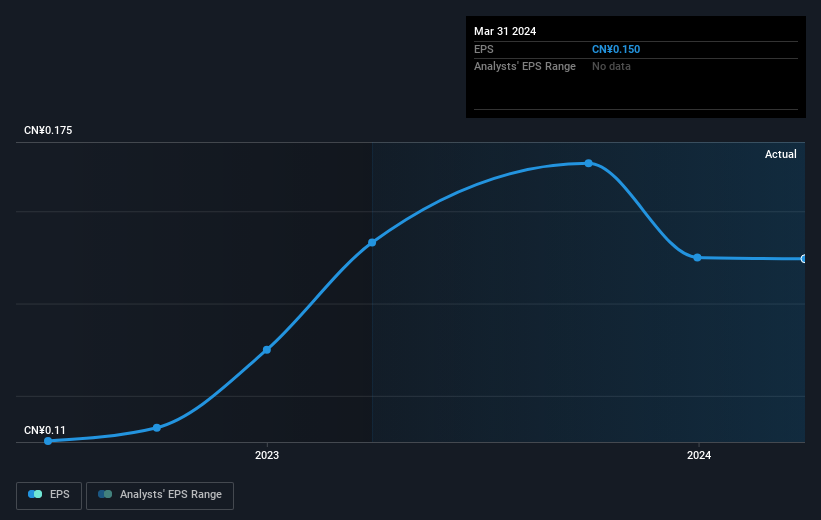

While markets are a powerful pricing mechanism, share prices reflect not only underlying company performance but also investor sentiment. By comparing earnings per share (EPS) and share price changes over time, we can get a sense of how investor attitudes toward a company have changed over time.

Unfortunately, Ningbo Henghe Precision Industry Ltd. saw its earnings decline by 2.3% over the past year. The 30% drop in share price is actually larger than the drop in earnings. Not surprisingly, the market is becoming more cautious on the stock given the lack of earnings growth. However, the market is still bullish on the stock given the P/E ratio of 54.91.

The company’s earnings per share (over time) is shown in the image below (click to see the exact numbers).

It might be worth taking a look at our free Ningbo Henghe Precision Industry Ltd. earnings, revenue and cash flow report.

A different perspective

We regret to report that Ningbo Henghe Precision Industry Ltd. shareholders are down 29% for the year (even including dividends). Unfortunately, that’s worse than the broader market decline of 16%. However, it’s inevitable that some stocks will become oversold in a falling market. The key is to keep an eye on fundamental developments. Long-term investors wouldn’t be so upset, given that they would have earned 1.8% each year over five years. It could be that the recent sell-off represents an opportunity, so it might be worth checking the fundamental data for signs of a long-term growth trend. While it’s worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We’ve found 3 warning signs for Ningbo Henghe Precision IndustryLtd You should be aware.

If you would rather check out another company — one with potentially better financials — then don’t miss this free List of companies that have proven their ability to increase their earnings.

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks currently trading on Chinese exchanges.

Valuation is complex, but we are here to simplify it.

Discover whether Ningbo Henghe Precision IndustryLtd could be under- or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.