Did you know that there are some financial metrics that can give clues to a potential multi-bagger? Ideally, a company will exhibit two trends: first, a growing return on the capital employed (ROCE) and secondly an increasing Crowd of the capital employed. Essentially, this means that a company has profitable initiatives in which it can continue to reinvest, which is a characteristic of a compounding machine. However, at first glance Insulators from NGK (TSE:5333) We are not exactly thrilled about the development of yields, but let’s take a closer look.

What is return on capital employed (ROCE)?

If you’ve never worked with ROCE before, it measures the “return” (profit before tax) that a company earns on the capital employed in its business. The formula for this calculation at NGK Insulators is:

Return on capital = earnings before interest and taxes (EBIT) ÷ (total assets – current liabilities)

0.067 = 65 billion JP¥ ÷ (1.1 tons JP¥ – 179 billion JP¥) (Based on the last twelve months to June 2024).

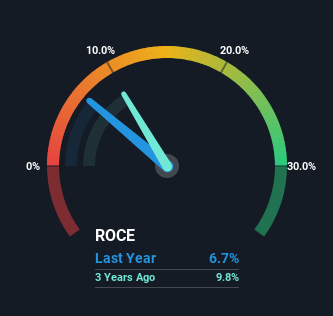

So, NGK Insulators has a ROCE of 6.7%. This is a low number in itself, but it is roughly the average of 7.9% for the engineering industry.

Check out our latest analysis for NGK Insulators

In the chart above, we have compared NGK Insulators’ ROCE with past performance, but the future is arguably more important. If you want, you can see the forecasts of the analysts who are covering NGK Insulators for free.

How are returns developing?

When we looked at the ROCE trend at NGK Insulators, we weren’t very confident. Over the last five years, the return on capital has fallen from 8.6% five years ago to 6.7%. The company is now using more capital, but this hasn’t had a significant impact in terms of revenue over the last 12 months, so this could indicate longer-term investments. It’s worth keeping an eye on the company’s earnings from now on to see if these investments actually end up contributing to the bottom line.

The conclusion

In conclusion, we found that while NGK Insulators is reinvesting in the business, earnings are declining. However, the market must expect these trends to improve, as the stock has gained 56% over the past five years. However, unless these underlying trends continue to be positive, we would not get our hopes up too much.

However, NGK insulators carry some risks and we have found 1 warning label for NGK insulators that might interest you.

For those who like to invest in solid companies, look at this free List of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we are here to simplify it.

Discover if NGK Insulators might be undervalued or overvalued with our detailed analysis, Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.