Did you know that there are some financial metrics that can give clues to a potential multibagger? Firstly, we want to see a growing return on the capital employed (ROCE) and then alongside it an ever increasing base of the capital employed. When you see this, it usually means that it is a company with a great business model and numerous profitable reinvestment opportunities. After researching Samsung SDSLtd (KRX:018260) – we don’t think the current trends fit the mold of a multi-bagger.

Understanding Return on Capital Employed (ROCE)

If you have never worked with ROCE, it measures the “return” (profit before tax) that a company generates on the capital employed in its business. The formula for this calculation at Samsung SDSLtd is:

Return on capital = earnings before interest and taxes (EBIT) ÷ (total assets – current liabilities)

0.084 = ₩839b ÷ (₩12t – ₩2.4t) (Based on the last twelve months to March 2024).

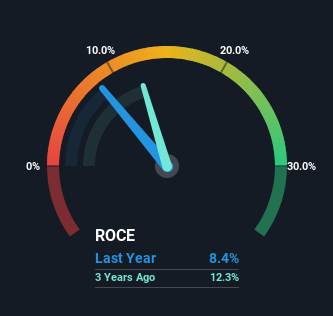

Therefore, Samsung SDSLtd has a ROCE of 8.4%. This is a low return on capital in itself, but is within the industry average return of 8.0%.

Check out our latest analysis for Samsung SDSLtd

In the chart above, we have compared Samsung SDSLtd’s ROCE with past performance, but the future is arguably more important. If you are interested, you can check out analyst forecasts in our free Analyst report for Samsung SDSLtd.

What does the ROCE trend tell us for Samsung SDSLtd?

When we looked at the ROCE trend at Samsung SDSLtd, we were not very confident. To be more specific, ROCE has fallen by 13% over the past five years. And considering that revenue has fallen while more capital has been deployed, we would be cautious. If this were to continue, you could be looking at a company that is trying to reinvest in growth but is actually losing market share as revenues have not grown.

Our opinion on the ROCE of Samsung SDSLtd

We are a little concerned about Samsung SDSLtd because even though more capital has been invested in the company, both return on capital and revenues have declined. Long-term shareholders who have owned the stock over the past five years have seen their investment reduced by 21%. So it seems the market doesn’t like these trends either. Given the less than great underlying trends in these areas, we would consider looking elsewhere.

And one more thing: We have found 1 warning sign with Samsung SDSLtd and understanding it should be part of your investment process.

Although Samsung SDSLtd does not have the highest return, check out this free List of companies with solid balance sheets and high returns on equity.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.