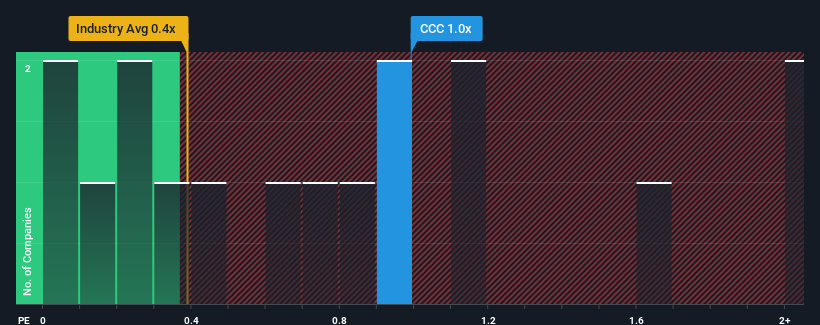

With an average price-to-sales ratio (or “P/S”) of almost 0.8x in the Polish specialty retail sector, you might not care if you CCC SAs (WSE:CCC) P/S ratio of 1x. This may not be surprising, but if the P/S ratio is not justified, investors may be missing out on a potential opportunity or ignoring an impending disappointment.

Check out our latest analysis for CCC

How CCC performed

With revenue growth that has lagged behind most other companies recently, CCC has been relatively sluggish. Perhaps the market is expecting future revenue growth that has prevented a decline in P/S. However, if that doesn’t happen, investors could fall into the trap of overpaying for the stock.

If you want to know what analysts are predicting for the future, you should check out our free Report on CCC.

Do the sales forecasts match the P/S ratio?

To justify its P/S ratio, CCC would need to achieve industry-like growth.

First, if we look back, we see that the company managed to grow its revenue by a respectable 3.6% last year. This was backed up by an excellent period prior to that, where revenue grew by a total of 65% over the last three years. So, first, we can confirm that the company has done a great job of growing its revenue during that time.

Looking ahead, the nine analysts covering the company expect revenue to grow by 12% per year over the next three years, while the rest of the industry is forecast to grow by just 7.3% per year, which is significantly less attractive.

Against this backdrop, we find it interesting that CCC is trading at a fairly similar price-to-earnings ratio compared to the industry. Apparently, some shareholders are skeptical of the forecasts and have accepted lower selling prices.

The last word

In our view, the price-to-sales ratio does not serve primarily as a valuation tool, but rather helps to assess current investor sentiment and future expectations.

We noted that CCC is currently trading at a lower than expected price-to-sales ratio because its forecast revenue growth is higher than the wider industry. There could be some risks that the market is pricing in that prevent the price-to-sales ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price, which, while stable, could be higher given the revenue forecasts.

Please note, however, CCC shows 3 warning signals in our investment analysis, and one of them is worrying.

If you like strong, profitable companies, then you should check this out free List of interesting companies that trade at a low P/E ratio (but have proven that they can grow their earnings).

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.