Iveda Solutions, Inc. (NASDAQ:IVDA) may be on the verge of a major business success, so we wanted to shed some light on the company. Iveda Solutions, Inc. provides artificial intelligence (AI) and digital transformation technologies in the United States and Taiwan. The $4.9 million market cap company posted a loss of $3.2 million in the last fiscal year and a loss of $3.5 million in the last twelve months, resulting in an even wider gap between loss and breakeven. Since the path to profitability is the topic that concerns Iveda Solutions investors, we decided to gauge the market sentiment. In this article, we will look at the expectations for the company’s growth and when analysts expect profitability.

Check out our latest analysis for Iveda Solutions

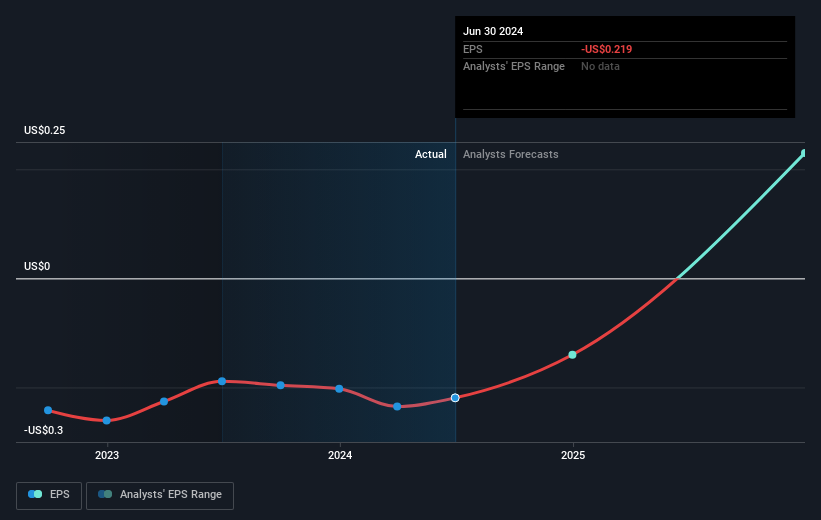

According to some analysts at American Software, Iveda Solutions is close to breaking even. They expect the company to report a final loss in 2024 before turning a profit of $3.9 million in 2025. The company is therefore expected to break even in just over a year. How fast does the company need to grow each year to break even by 2025? Based on the analysts’ estimates, they expect the company to grow at an average rate of 158% year-over-year, which indicates high analyst confidence. If this rate proves to be too aggressive, the company may become profitable much later than analysts predict.

Since this is a high-level overview, we won’t go into detail about Iveda Solutions’ upcoming projects, but keep in mind that, overall, a high growth rate is nothing unusual, especially when a company is in an investment phase.

We would like to point out that the company has managed its capital prudently and 20% of equity is comprised of debt. This means that it has financed its operations predominantly from equity and its low leverage reduces the risk of investing in the loss-making company.

Next Steps:

This article is not intended to be a comprehensive analysis of Iveda Solutions, so if you want to gain a deeper understanding of the company, take a look at Iveda Solutions’ company page on Simply Wall St. We have also compiled a list of important aspects that you should examine in more detail:

- Historical performance record: How has Iveda Solutions performed in the past? Go into more detail in the analysis of its past track record and take a look at the free visual representations of our analysis for more clarity.

- Management Team: Having an experienced management team at the top gives us confidence in the company – see who sits on Iveda Solutions’ board and the CEO’s background.

- Other high-performing stocks: Are there other stocks with better prospects and proven track records? Discover our free list of these great stocks here.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.