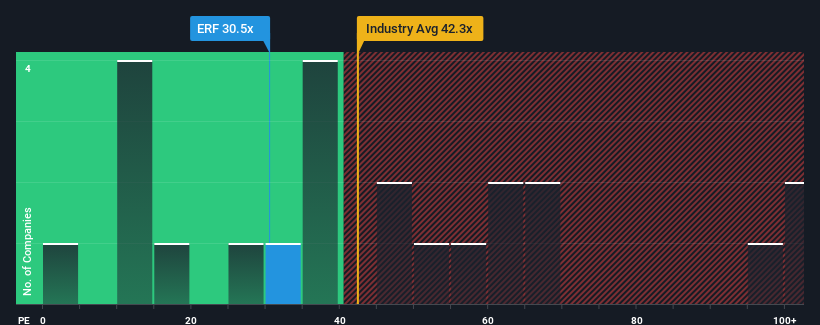

When almost half of the companies in France have a price-to-earnings ratio (P/E) of less than 14x, you can consider Eurofins Scientific SE (EPA:ERF) is a stock to avoid at all costs, with its P/E ratio of 30.5. However, it is not advisable to simply take the P/E ratio at face value, as there may be an explanation for why it is so high.

Eurofins Scientific has been struggling recently as its earnings have been declining faster than most other companies. One possibility is that the P/E ratio is high because investors believe the company will completely turn things around and overtake most others in the market. If not, then existing shareholders could be very nervous about the profitability of the share price.

Check out our latest analysis for Eurofins Scientific

Do you want the full picture of analyst estimates for the company? Then our free Eurofins Scientific’s report will help you find out what’s on the horizon.

Is there enough growth for Eurofins Scientific?

To justify its P/E ratio, Eurofins Scientific would have to deliver outstanding growth that significantly outperformed the market.

Looking back, last year saw a frustrating 21% decline for the company. As a result, earnings from three years ago were down 61% overall. Accordingly, shareholders were disappointed with medium-term earnings growth rates.

Looking ahead, analysts expect earnings to grow 25% per year over the next three years. With the market only forecast to grow 14% per year, the company is poised for stronger results.

Given this background, it is understandable that Eurofins Scientific’s P/E ratio is higher than most other companies. It seems that shareholders are not interested in selling something that potentially has a better future ahead of it.

The last word

In our opinion, the price-earnings ratio is not primarily used as a valuation tool, but rather to assess current investor sentiment and future expectations.

As we suspected, our study of Eurofins Scientific’s analyst forecasts found that its above-average earnings outlook contributes to its high P/E ratio. Currently, shareholders are happy with the P/E ratio as they are fairly confident that future earnings are not at risk. Under these circumstances, it is difficult to imagine the share price falling much in the near future.

It is always necessary to consider the ever-present specter of investment risk. We have found 2 warning signals with Eurofins Scientificand understanding them should be part of your investment process.

It is important, Make sure you are looking for a great company and not just the first idea that comes to mind. So take a look at the free List of interesting companies with strong recent earnings growth (and low P/E ratios).

Valuation is complex, but we are here to simplify it.

Find out if Eurofins Scientific could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.