Key findings

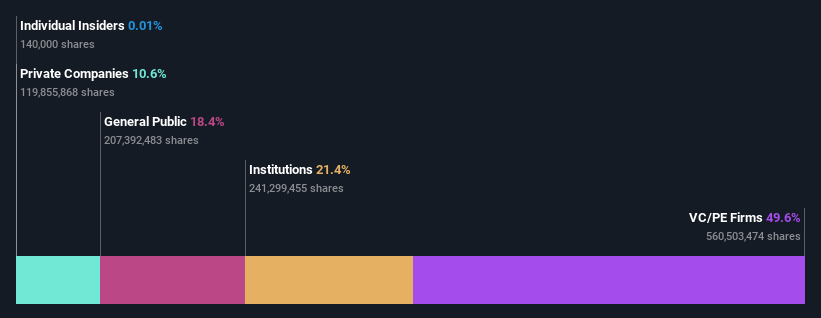

If you want to know who really controls Shenzhen Transsion Holdings Co., Ltd. (SHSE:688036), you need to look at the composition of its share registry. And the group that holds the biggest piece of the pie is private equity firms with 50% shares. That means the group benefits the most when the stock rises (or loses the most when there is a downturn).

Institutions now make up 21% of the company’s shareholders. Institutions often own shares in more established companies, while it’s not uncommon to see insiders own a number of smaller companies.

Let’s take a closer look at what the different shareholder types can tell us about Shenzhen Transsion Holdings.

Check out our latest analysis for Shenzhen Transsion Holdings

What does institutional ownership tell us about Shenzhen Transsion Holdings?

Institutional investors often compare their own returns to those of a commonly followed index, so they typically consider buying larger companies included in the relevant benchmark index.

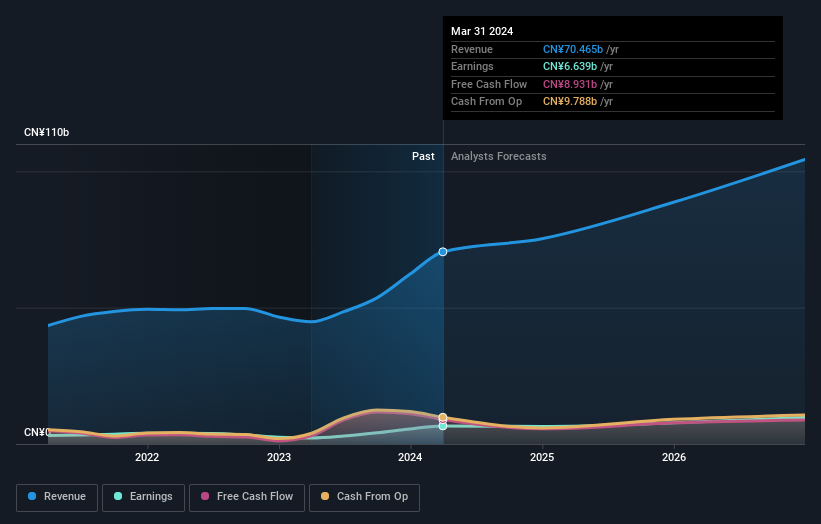

We can see that Shenzhen Transsion Holdings has institutional investors; and they hold a good portion of the company’s shares. This suggests some credibility among professional investors. But we cannot rely on this fact alone since institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there is always a risk that they are involved in a “crowd trade.” If such a trade goes wrong, multiple parties may compete to sell the shares quickly. This risk is higher with a company without a growth history. You can see Shenzhen Transsion Holdings’ historical earnings and revenue below, but keep in mind there’s always more to the story.

Shenzhen Transsion Holdings is not owned by hedge funds. Our data shows that the largest shareholder is Shenzhen Transsion Investment Co., Ltd. with 50% of the outstanding shares. CITIC Securities Company Limited, Asset Management Arm is the second largest shareholder with 6.3% of the common shares and Xinyu Chuan Jiali Enterprise Management Partnership Enterprise (Limited Partnership) holds about 5.5% of the company shares.

After careful investigation, we found that the two largest shareholders together control more than half of the company’s shares, meaning they have significant influence over the company’s decisions.

While studying institutional ownership of a company can enrich your research, it is also a good practice to research analyst recommendations to get a deeper understanding of a stock’s expected performance. There are many analysts covering the stock, so it might be worth checking their forecasts as well.

Insider ownership of Shenzhen Transsion Holdings

The definition of an insider may vary slightly in different countries, but members of the board of directors are always included. Management is ultimately responsible to the board of directors. However, it is not uncommon for managers to be members of the board of directors, especially if they are founders or CEOs.

Insider ownership is positive when it signals that management thinks like the true owners of the company. However, high insider ownership can also give enormous power to a small group within the company. This can be negative in some circumstances.

Our data suggests that insiders own less than 1% of Shenzhen Transsion Holdings Co., Ltd. in their own names. However, they might have indirect interests through a corporate structure that we haven’t detected. As it’s a large company, we would only expect insiders to own a small percentage of it. However, it’s worth noting that they own CN¥10m worth of shares. Recent purchases and sales are arguably just as important to consider. You can click here to see if insiders have been buying or selling.

Public property

The general public, usually retail investors, owns an 18% stake in Shenzhen Transsion Holdings. While this stake size may not be enough to sway a policy decision in their favor, they can still collectively influence company policy.

Private equity ownership

Private equity firms own a 50% stake in Shenzhen Transsion Holdings, suggesting they can influence key policy decisions. Sometimes we see private equity stick around for the long term, but generally they have a shorter investment horizon and, as the name suggests, do not invest much in listed companies. After some time, they may look to sell their capital and deploy it elsewhere.

Private company ownership

We can see that private companies own 11% of the shares outstanding. It’s difficult to draw conclusions from this fact alone, so it’s worth investigating who owns these private companies. Sometimes insiders or other related parties have an interest in shares of a public company through a separate private company.

Next Steps:

It’s always worth thinking about the different groups that own shares in a company. But to better understand Shenzhen Transsion Holdings, we need to consider many other factors. Consider, for example, the ever-present specter of investment risk. We have identified 1 warning signal with Shenzhen Transsion Holdings, and understanding them should be part of your investment process.

But ultimately It is the futurenot the past, will determine how well the owners of this company will perform, so we think it wise to take a look at this free report showing whether analysts are predicting a better future.

NB: The figures in this article are calculated using the last twelve months’ data, which refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the figures in the annual report.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.