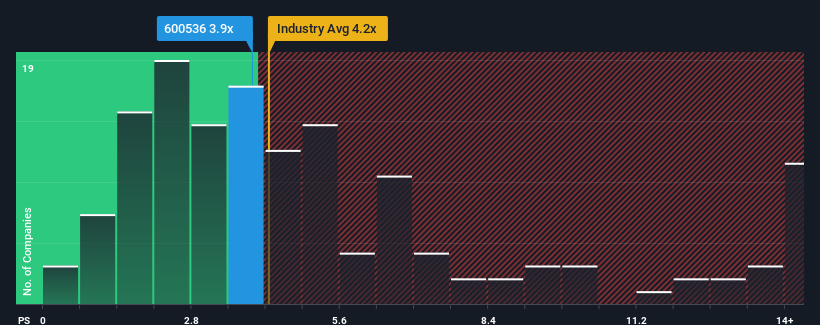

It is no exaggeration to say that The China National Software & Service Company Limited (SHSE:600536) price-to-sales (or “P/S”) ratio of 3.9 currently seems fairly “average” for companies in the software industry in China, where the median P/S ratio is around 4.2. While this may not be surprising, if the P/S ratio is not justified, investors could miss a potential opportunity or ignore an impending disappointment.

Check out our latest analysis for China National Software & Service

How has China National Software & Service developed recently?

While the industry has seen revenue growth recently, China National Software & Service’s revenue has gone into reverse, which is not good. Perhaps the market is expecting the weak revenue performance to improve and the price-to-earnings ratio not to drop. However, if that doesn’t happen, investors could fall into a trap and overpay for the stock.

If you want to know what analysts are predicting for the future, you should check out our free Report on China National Software & Service.

Is China National Software & Service forecast to see revenue growth?

To justify its price-to-sales ratio, China National Software & Service would need to achieve industry-like growth.

First, if we look back, the company’s revenue growth last year was not exactly exciting as it recorded a disappointing 33% decline. This means that there has been a decline in revenue over the long term as well, with revenue declining by a total of 21% over the last three years. Therefore, it is fair to say that the revenue growth of late has been unwelcome for the company.

According to the three analysts who cover the company, revenue is expected to grow 24% next year, in line with the 26% growth forecast for the industry as a whole.

With this information, we can see why China National Software & Service trades at a fairly similar price-to-earnings ratio to the industry. Apparently shareholders are content to just hold on while the company keeps a low profile.

What can we learn from China National Software & Service’s P/S?

It’s not a good idea to use the price-to-sales ratio alone to decide whether to sell your stock, but it can be a useful guide to the company’s future prospects.

The price-to-earnings ratio of a Chinese national software and services company seems about right to us, as analysts are forecasting a revenue outlook similar to that of the software industry. At this point, investors believe that the potential for revenue improvement or deterioration is not large enough to drive the price-to-earnings ratio up or down. All in all, unless there are major shocks to the price-to-earnings and revenue estimates, it is hard to imagine the stock price moving much in one direction or the other in the near future.

Many other significant risk factors can be found in the company’s balance sheet. Our free Using the balance sheet analysis for China National Software & Service with six simple checks, you can identify all possible risks.

If you uncertain about the strength of China National Software & Service’s businesswhy not explore our interactive stock list with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.