Inscobee, Inc. (KRX:006490) shareholders are no doubt pleased to see the share price rise 28% over the past month, although it is still trying to make up the ground it recently lost. However, last month’s gains were not enough to compensate shareholders, as the share price is still down 5.9% over the past twelve months.

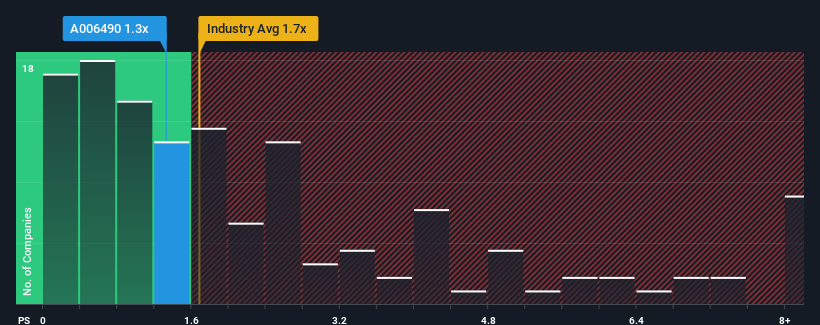

Since the price has skyrocketed, one might think that Inscobee is a stock not worth investigating, as its price-to-sales (or “P/S”) ratio of 1.3x puts nearly half of the companies in Korea’s telecom industry at P/S ratios below 0.4x. However, the P/S could be high for a reason and further research is needed to determine if it is justified.

Check out our latest analysis for Inscobee

How has Inscobee developed recently?

The last few years have been quite beneficial for Inscobee as its revenue has grown very strongly. Many seem to expect that the strong revenue performance will outperform most other companies in the coming period, which has increased investors’ willingness to pay more for the stock. If not, existing shareholders may be a little nervous about the profitability of the share price.

Although there are no analyst estimates for Inscobee, take a look at these free Data-rich visualization to see how the company is performing in terms of profit, revenue and cash flow.

Do the sales forecasts correspond to the high P/S ratio?

To justify its P/S ratio, Inscobee would need to deliver impressive cross-industry growth.

If we look at last year’s revenue growth, the company has seen a fantastic 30% increase. The strong recent performance means that it has achieved a total revenue increase of 65% over the last three years. Accordingly, shareholders would definitely have welcomed these medium-term revenue growth rates.

Compared to the industry, growth of just 4.6 percent is forecast for the next twelve months. However, based on the latest medium-term annual sales figures, the company’s momentum is stronger.

With this information, we can see why Inscobee trades at such a high price-to-earnings ratio relative to the industry. Presumably, shareholders aren’t interested in dumping something they believe will continue to outmaneuver the entire industry.

What can we learn from Inscobee’s P/S?

Inscobee shares have taken a big step north, but their price-to-sales ratio has risen as a result. It’s not useful to use the price-to-sales ratio alone to decide whether you should sell your shares, but it can be a handy guide to the company’s future prospects.

As we suspected, our research into Inscobee found that its three-year revenue trends contribute to its high P/S ratio, as they are better than current industry expectations. In the eyes of shareholders, the likelihood of a sustained growth trajectory is high enough to prevent the P/S ratio from falling. Under these circumstances, if recent medium-term revenue trends continue, it is difficult to imagine the share price falling much in the near future.

You should always think about the risks. A typical example: We have 3 warning signs for Inscobee You should be aware of this, and one of them is one we are not particularly happy with.

If you are looking for companies with solid earnings growth in the pastyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.