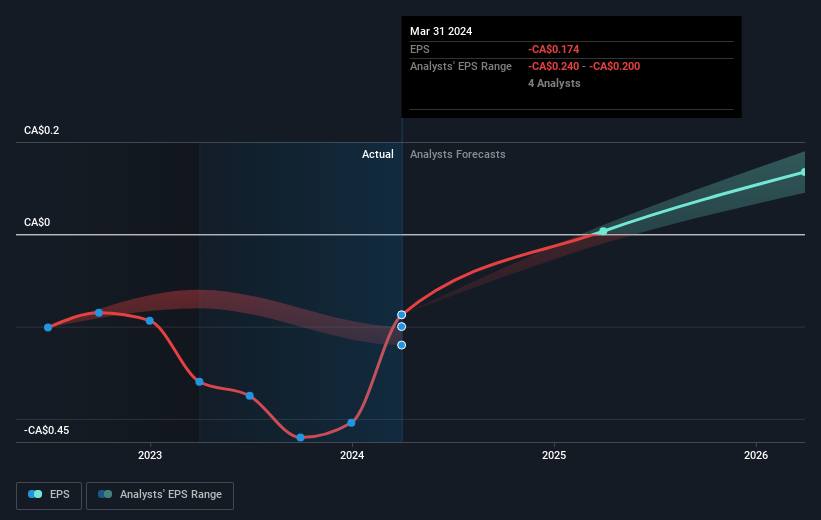

Alithya Group Inc. (TSE:ALYA) is potentially on the verge of a major business success, so we want to shed some light on the company. Alithya Group Inc. provides strategy and digital technology services in Canada, the United States, and Europe. As of March 31, 2024, the company with a market capitalization of 182 million Canadian dollars posted a loss of 17 million Canadian dollars for its last fiscal year. The biggest concern among investors is Alithya Group’s path to profitability – when will it break even? We’ve put together a quick overview of industry analysts’ expectations for the company, its breakeven year, and its implied growth rate.

Check out our latest analysis for Alithya Group

According to the 4 industry analysts that cover Alithya Group, the consensus is that breakeven is near. They expect the company to report a final loss in 2024 before making a profit of CA$1.1 million in 2025. So, the company is forecast to break even in about 12 months or sooner. We calculated the rate at which the company needs to grow to meet consensus forecasts that predict breakeven within 12 months. It turns out that a compound annual growth rate of 105% is expected, indicating high analyst confidence. If this rate proves too aggressive, the company may become profitable much later than analysts predict.

Since this is a high-level overview, we won’t go into detail about Alithya Group’s upcoming projects, but keep in mind that a high growth rate is generally nothing unusual, especially when a company is in an investment phase.

Before we conclude, there is one more point worth mentioning. Alithya Group is currently relatively highly leveraged. Normally, debt should not exceed 40% of equity, which in the case of Alithya Group is 67%. Higher debt requires tighter capital management, which increases the risk of investing in the loss-making company.

Next Steps:

This article is not intended to be a comprehensive analysis of Alithya Group, so if you want to gain a deeper understanding of the company, take a look at Alithya Group’s company page on Simply Wall St. We’ve also compiled a list of key factors to consider:

- Evaluation: What is Alithya Group worth today? Is future growth potential already factored into the price? The intrinsic value infographic in our free research report helps visualize whether Alithya Group is currently mispriced by the market.

- Management Team: Having an experienced management team at the top gives us confidence in the company – see who sits on the Alithya Group board and the CEO’s background.

- Other high-performing stocks: Are there other stocks with better prospects and proven track records? Discover our free list of these great stocks here.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.