“Hindenburg has a Notice of the event for a number of violations in India. It is unfortunate that instead of responding to the request for comment, they have decided to attack the credibility of Sebi and attempt to assassinate the reputation of the Sebi Chairman,” the pair said in a two-page statement, 15 hours after issuing the first denial early Sunday.

The Sebi chief and Dhaval, both of whom have long careers in business, refuted this point by point, saying that the investment The contributions to the fund were made when both were still private individuals.

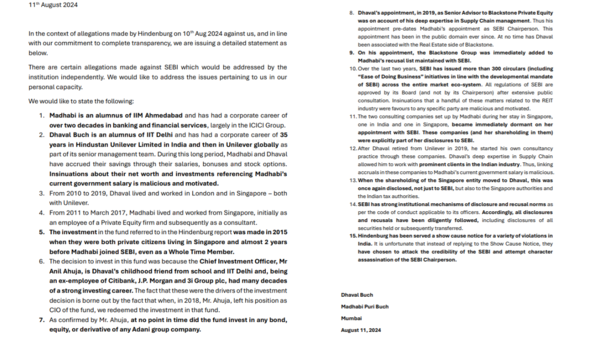

“The decision to invest in this fund was taken because the Chief Investment Officer, Mr. Anil Ahuja, is Dhaval’s childhood friend from school and IIT Delhi and has many decades of a successful career as an investor as a former employee of Citibank, JP Morgan and 3i Group plc. That these were the driving forces behind the investment decision is confirmed by the fact that we withdrew the investment in this fund when Mr. Ahuja left his position as CIO of the fund in 2018. As confirmed by Mr. Ahuja, the fund has not invested in any bonds, equities or derivatives of any Adani group company at any point of time,” the statement said.

Hindenburg’s report had alleged that Puri Buch and Dhaval had invested in two funds that had Adani shares, leading to Sebi’s “failure” in its investigation into the ports and consumer goods major. The report had also alleged that Ahuja had served as a board member of Adani Enterprises and hinted at irregularities.

Separately, 360 One Wam, which managed the fund in which the couple had invested, stated: “Throughout the life of the Fund, IPE-Plus Fund 1 did not invest in shares of the Adani Group, directly or indirectly through any fund… The Fund was managed by the Investment Manager as a discretionary fund. No investor was involved in the operations or investment decisions of the Fund. Ms. Madhabi Buch and Mr. Dhaval Book‘S

Participation in the fund represented less than 1.5% of total inflows into the fund.”

Adani also rejected the Hindenburg Report They said it was a “malicious, insidious and manipulative selection of publicly available information to reach predetermined conclusions.”

It said Anil Ahuja was a nominated director of Adani Power’s 3i investment fund (2007-2008) and later a director of Adani Enterprises until 2017. “The Adani Group has no business dealings with the individuals or matters mentioned in this targeted attempt to damage our reputation. We remain committed to transparency and compliance with all legal and regulatory requirements,” the statement said.

In their statement, the Sebi chief and Dhaval said that the two consultancy firms named by Hindenburg became inactive immediately after their appointment to the regulator. “These companies (and their shareholding in them) were explicitly part of their disclosures to Sebi… When the shareholding in the Singapore company was transferred to Dhaval, this was again disclosed, not only to Sebi but also to the Singapore authorities and the Indian tax authorities.”

They also refuted allegations that it was inappropriate for Dhaval to take up the advisory role at Blackstone, arguing that this was due to his “great expertise” in supply chain management, a job he had done at Unilever. “…his appointment preceded Madhabi’s appointment as Sebi chairman. That appointment has been public knowledge since then. Dhaval was not associated with Blackstone’s real estate arm at any point of time.”

They insisted that all required disclosures had been made. “Sebi has strong institutional mechanisms for disclosures and denial norms as per the Code of Conduct applicable to its officers. Accordingly, all disclosures and denials have been diligently followed including the disclosure of all securities held or subsequently transferred.”