Did you know that there are some financial metrics that can give clues to a potential multibagger? Firstly, we want to see a growing return on the capital employed (ROCE) and then alongside it an ever increasing base of capital employed. Essentially, this means that a company has profitable initiatives in which it can continue to reinvest, which is a characteristic of a compounding machine. However, after a quick look at the numbers, we do not believe Peiport Holdings (HKG:2885) has the potential to be a multibagger in the future, but let’s take a look at why that might be the case.

What is return on capital employed (ROCE)?

If you’ve never worked with ROCE before, it measures the “return” (earnings before tax) that a company generates on the capital employed in its business. To calculate this metric for Peiport Holdings, the formula is:

Return on capital = earnings before interest and taxes (EBIT) ÷ (total assets – current liabilities)

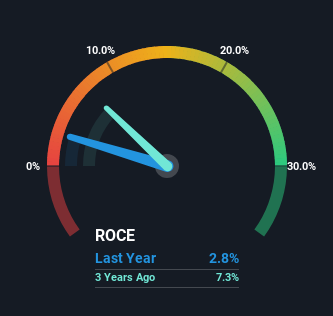

0.028 = HK$9.6 million ÷ (HK$409 million – HK$65 million) (Based on the last twelve months to December 2023).

So, Peiport Holdings has a ROCE of 2.8%. Ultimately, this is a low return and is below the electronics industry average of 7.5%.

Check out our latest analysis for Peiport Holdings

While the past is not representative of the future, it can be useful to know a company’s historical performance, which is why we created the chart above. If you want to delve into historical earnings, check out this free Charts with detailed information on the sales and cash flow development of Peiport Holdings.

What can we learn from Peiport Holdings’ ROCE trend?

As for Peiport Holdings’ historical ROCE movements, the trend is not fantastic. Around five years ago, the return on capital was 26%, but since then it has fallen to 2.8%. However, it looks like Peiport Holdings is reinvesting for long-term growth because although the capital employed has increased, the company’s revenues have not changed much over the past 12 months. It’s worth keeping an eye on the company’s earnings from now on to see if these investments actually end up contributing to the bottom line.

On a related note, Peiport Holdings has reduced its current liabilities to 16% of total assets. We could partially link this to the decline in ROCE. In effect, this means that their suppliers or short-term creditors are putting less money into the company, which reduces some elements of risk. Some would argue that this reduces the company’s efficiency in generating ROCE, as it is now funding more of its operations with its own money.

Our assessment of Peiport Holdings’ ROCE

In summary, while we are somewhat encouraged by Peiport Holdings’ reinvestment in its own business, we are aware that earnings are shrinking. With the stock up an impressive 45% over the past five years, investors must believe that even better times are ahead. However, unless these underlying trends continue to be positive, we would not get our hopes up too much.

And one more thing: We have found 2 warning signs with Peiport Holdings (at least 1, which is a little worrying), and it would certainly be useful to understand them.

While Peiport Holdings may not have the highest returns right now, we have compiled a list of companies that are currently generating a return on equity of over 25%. Check it out free List here.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.