- Copper shortage threatens due to low and slow mining permits

- Deutsche Bank: Price of over 10,000 US dollars/t needed to stimulate new supply

- Large companies have long lead times in Chile – junior copper companies could fill the gap

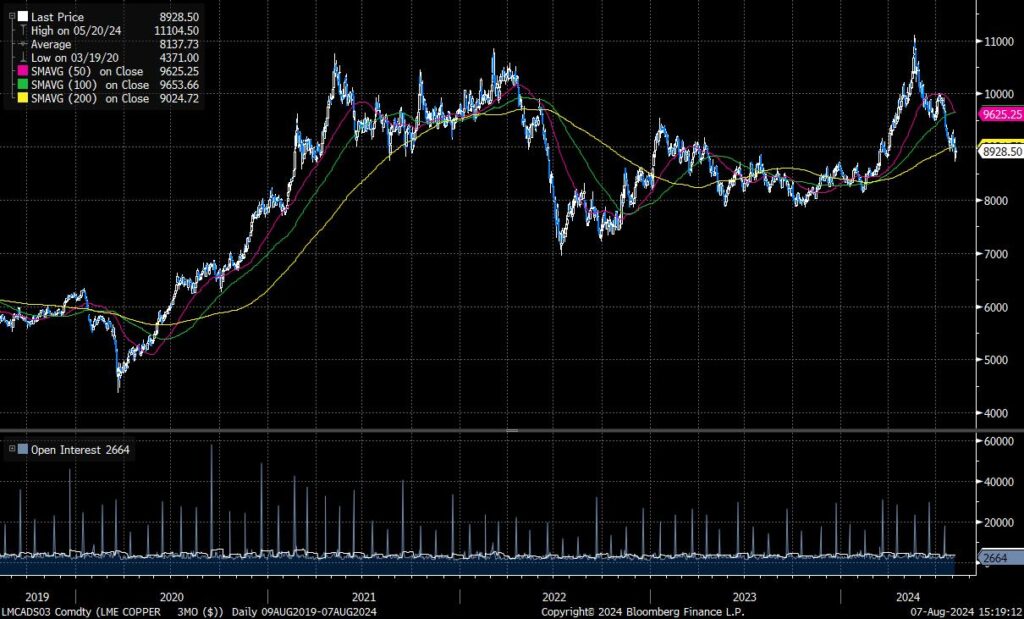

Copper prices peaked at $11,104.50/t in May, exceeding even the wildest dreams of long-time mining analysts. This level is well above Deutsche Bank’s year-end target of $10,000/t and reflects improved global growth and a rise in speculative capital flows against a backdrop of structurally tight supply.

The price is currently just below USD 9,000/t, still above the 12-month average of USD 8,858/t and the 5-year average of USD 8,137/t, but the global investment bank believes that returning above the USD 10,000/t mark will be key to encouraging new mines.

The number of permits for copper mines is alarmingly low, having been in the single digits for the past seven years. According to Deutsche Bank, this means that the copper market, which was previously considered balanced in the short term, is expected to slip into deficit starting this year.

This deficit is forecast to reach 340,000 tonnes in 2026, partly due to the boom in artificial intelligence and the energy transition, which will see data centres, power grid modernisation, electric vehicles, charging stations, solar systems and wind turbines boost demand.

Cable manufacturers are experiencing a boom. Nexans SA’s Halden plant is sold out until 2028, and some customers sourcing copper-rich cables are reporting backlogs of up to 12 years due to the soaring demand for connecting renewable energy to the grid.

Goldman Sachs has even called copper “the new oil” because of its central role in the energy transition.

Ultimately, more offerings need to be put online as quickly as possible.

In the short term, Deutsche Bank sees better approval prospects next year, noting that 2025 is emerging as a more meaningful year “as several companies aim to advance projects to board approval, driven by higher cash flows and an improving investment environment in several mining districts.”

However, the medium and long-term supply outlook is not so rosy.

Large companies make copper transactions

Deutsche Bank referred to the measures taken by large corporations such as BHP (ASX:BHP), The company recently attempted to acquire Anglo American and later signed up for a $3.2 billion deal to acquire a key development project in Argentina, highlighting “the strategic importance of copper and the challenges of expanding supply at a time when ‘forward-looking’ demand drivers (generally electrification) are gaining momentum.”

Chile seems to be the right place for this, as a number of large companies have been active in the country’s copper business in recent months.

BHP has filed for approval to restart its Cerro Colorado copper mine by the end of the decade, after only placing it on maintenance and repair in December 2023. In July, the company acquired half of TSX-listed Filo Corp, with its Filo del Sol project and joint venture partner Lundin’s Josemaria deposit, for $3 billion. Both are located in the Vicuna region on the Chilean-Argentine border.

And then there’s Freeport, which is considering a pre-feasibility study for El Abra in partnership with Codelco. Construction would cost $7.5 billion and require a lead time of seven to eight years due to permitting requirements.

However, copper remains sensitive to supply fluctuations, underlined by news that BHP and Escondida in Rio, the world’s largest copper producer, could lose thousands of tonnes of production due to a strike after negotiations with the operators’ union over a new wage agreement failed.

Perfect timing for juniors in Chile

Pan Asia Metals (ASX:PAM) Chairman and CEO Paul Lock says the copper projects being considered by the major companies require more than 10 years to complete studies, opening the door for juniors like PAM, which owns the Rosario copper project just 10km from Codelco’s El Salvador copper mine in Chile.

“The more flexible, smaller-scale mining companies can focus on high-margin, low-capital- and operating-cost projects that the big players have no interest in,” he said.

According to Deutsche Bank, given the structural supply shortage, the market should place a higher value on companies that can deliver short-term growth.

And with capital costs rising 30 to 40 percent in recent years, “this will likely mean a steady increase in permits rather than a flood.”

According to Lock, this means that the coming supply deficit cannot easily be made up by short-term production. Companies that can deliver in these tighter time frames will also be drawn into the copper boom, “as these assets are needed to make up the subsequent deficit.”

PAM signed a binding option agreement to acquire 100 percent of Rosario on Tuesday.

Lock told the market that the project, which will see Pan Asia move beyond its traditional base of lithium exploration in Southeast Asia and Chile, has all the prerequisites for development and operation in the lower third of the global copper cost curve.

Rosario has the characteristics of a Manto style deposit, typically high grade for porphyries, with occurrences often in the 1-3% Cu range. Capstone Copper’s approximately 60,000 tonnes per annum Mantos Blancos mine is a low capital cost open pit Manto mine operating north of Rosario.

“Rosario offers a solid and cost-effective diversification strategy, copper is one of the key transition metals for global electrification alongside lithium,” he said in an ASX announcement this week.

“The supply and demand dynamics for copper producers are compelling due to the large deficits projected due to declining production and quality as well as the lack of new discoveries.

“For PAM, the Rosario Copper Project meets all of PAM’s requirements. It is located in an environment with rich infrastructure, offers potential processing solutions between Rosario and the nearest port, has the best copper grades in a significant number of rock chip samples and is located in a world class copper producing region known for its cost advantages.

“Basically, the project has everything it needs to position itself in the lower third of the cost curve.”

PAM share price today:

Who else has a Chilean copper piece?

Hot Chilli (ASX:HCH) is completing a pre-feasibility study for its 2.8 million tonne copper hub in Costa Fuego.

In March, the Company signed a letter of intent with the existing Las Losas port facility in Chile to negotiate a binding port services agreement. In May, it raised $31.9 million through a $24.9 million private placement and a $7 million share purchase plan to fund development and exploration activities over the next 18 months.

In terms of exploration, HCH has initiated several programs on newly acquired concessions in the Domeyko cluster, covering an area of 141 km² and representing a 25% increase in the Company’s total land holdings in the Costa Fuego.

Culpeo Minerals (ASX:CPO) operates the Vista Montana, Lana Corina and Fortuna projects in the country and recently announced the discovery of a significant copper deposit at Lana Corina over 454 m grading 0.93% CuEq from 90 m.

Both Lana Corina and Fortuna are located in the Chilean region of Coquimbo, which is known for its numerous world-class copper and gold mines.

And earlier this month, the company raised approximately $2.2 million through a placement at $0.04 per share to fund exploration.

Southern Hemisphere Mining (ASX:SUH) is also in the country, as the Llahuin copper-gold property is just a stone’s throw (8 km) from the $490 million El Espino copper-gold mine currently under construction in Pucobre.

According to SUH, the infrastructure being implemented for El Espino significantly reduces the risk to Llahuin, which currently has a resource of 169 million tonnes grading 0.4 percent copper.

The explorer is in the midst of a drilling program to test multiple targets to expand the resource base for a 25-year mine life.

Then there is Capstone Copper (ASX: CSC). The TSX-listed mining group has just updated the feasibility study for the Santo Domingo project in Chile and forecasts an average annual production of 68,000 tonnes of copper over 19 years at cash costs of US$0.22 per pound.

Capital costs increased from $1.5 billion to $2.3 billion, corresponding to a capital intensity of approximately $21,900 per tonne of copper equivalent produced.

At Stockhead, we tell it like it is. Although Pan Asia Metals, Culpeo Minerals and Hot Chili are Stockhead advertisers, they did not sponsor this article.