Following the solid earnings report from Ash-Sharqiyah Development Co. (TADAWUL:6060), the market reacted with higher share prices. However, we believe shareholders should be cautious as we found some concerning factors underlying the earnings.

Check out our latest analysis on developments in Ash-Sharqiyah

To understand the potential for per-share returns, it is important to consider how much a company is diluting shareholders. In fact, Ash-Sharqiyah Development issued 300% more new shares last year. Therefore, each share now receives a smaller share of earnings. To talk about net income without considering earnings per share is to get distracted by the big numbers and ignore the smaller numbers that per share Value. View Ash-Sharqiyah Development’s historical EPS growth by clicking this link.

A look at the impact of Ash-Sharqiyah Development’s dilution on earnings per share (EPS)

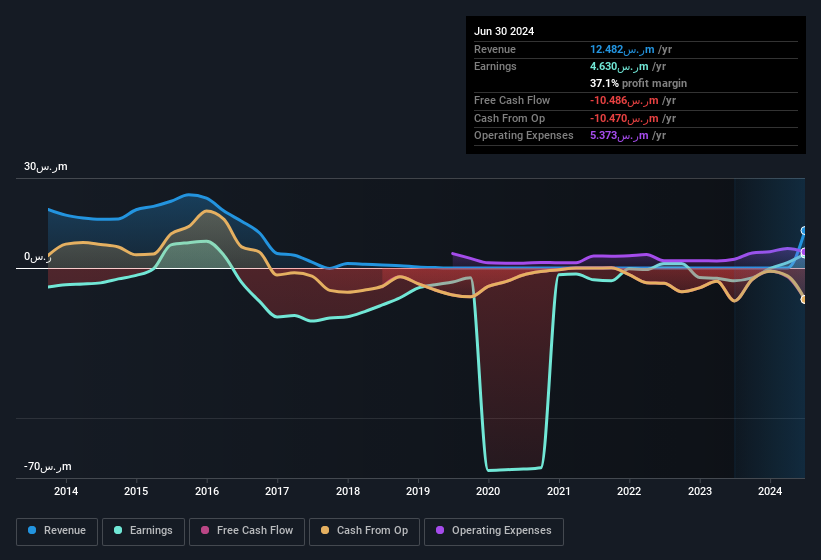

Ash-Sharqiyah Development was loss-making three years ago. And even if we focus only on the last twelve months, we don’t have a growth rate to speak of, as the company was loss-making a year ago as well. But maths aside, it’s always good to see a formerly unprofitable company bounce back (although we admit that earnings would have been higher had dilution not been required). So you can see that dilution has had a pretty significant impact on shareholders.

If Ash-Sharqiyah Development’s earnings per share can grow over time, it dramatically increases the chances that the share price will move in the same direction. On the other hand, however, we would be far less enthusiastic if we were told that earnings (but not earnings per share) were improving. For this reason, one could say that earnings per share are more important than net income in the long run, assuming the goal is to assess whether a company’s share price might rise.

Note: We always recommend investors to check balance sheet strength. Click here to access our balance sheet analysis of Ash-Sharqiyah Development.

Our assessment of Ash-Sharqiyah Development’s earnings performance

Ash-Sharqiyah Development has issued shares during the year, meaning that EPS performance has lagged behind net profit growth. Therefore, we believe Ash-Sharqiyah Development’s underlying earnings power may be lower than its statutory profit. On the positive side, the company has shown enough improvement to post a profit this year after losing money last year. Ultimately, it’s important to consider more than just the factors mentioned above if you want to properly understand the company. If you want to dive deeper into Ash-Sharqiyah Development, you should also investigate what risks it is currently facing. Note that Ash-Sharqiyah Development 2 warning signals in our investment analysis and 1 of them makes us a little uncomfortable…

This note only examined a single factor that can provide insight into the nature of Ash-Sharqiyah Development’s earnings. However, there are many other ways to form an opinion about a company. For example, many people consider a high return on equity to indicate a favorable business situation, while others like to “follow the money” and look for stocks that insiders are buying. You may want to look here. free Collection of companies with high return on equity or this list of stocks with high insider ownership.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.