The investment platform Public announces the launch of a bond account, a convenient way to invest in multiple bonds.

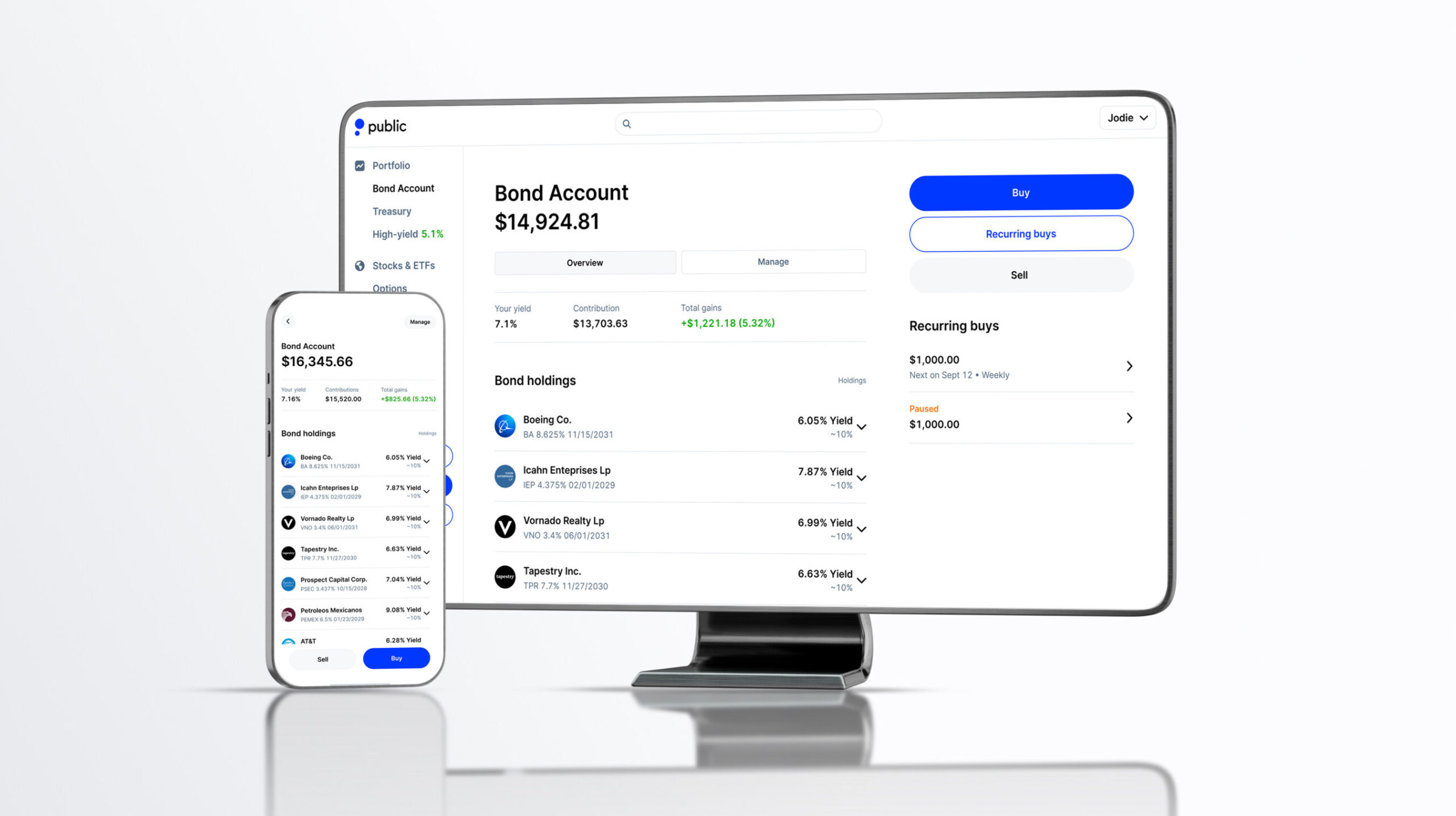

The new bond account allows members to invest in a wide range of ten corporate bonds issued by companies from different industries, including well-known companies.

By investing in a Public Bond Account, members can easily purchase ten corporate bonds from companies such as Boeing, Tapestry, Warner Media LLC, Main Street Capital Corp and Vornado Realty LP. The interest earned is automatically reinvested once it reaches approximately $1,000.

Members also have the opportunity to make recurring investments in their bond account. The ten bonds may change over time to adapt to changing market conditions.

“Last year we introduced the concept of the Treasury Account: an automated investment feature that made buying T-bills a simple experience for retail investors. The ease of use and high yield of short-dated Treasury bonds made them the most invested asset all year. Now we’re doing the same, but for corporate bonds, where yields are higher and the underlying investments are more diversified,” said Jannick Malling, co-CEO and co-founder of Public. “With interest rates potentially falling later this year and next, we’re hearing from investors who want to lock in a higher yield now, and our Bond Account allows you to invest in the bond market with just a few clicks.”

Members can track their accrued and projected income from the bond account through Public’s Income Center, a new way to view all interest payments on the platform. In the coming weeks, members will also be able to track dividend payments, individual government and corporate bonds, music royalties, and the bond account to visualize their past and future income.

To make the bond market more accessible, Public’s minimum investment amount for its bond account is $1,000, which is ten times lower than the minimum investment amounts for individual bonds on other platforms, which are often $10,000 or more.