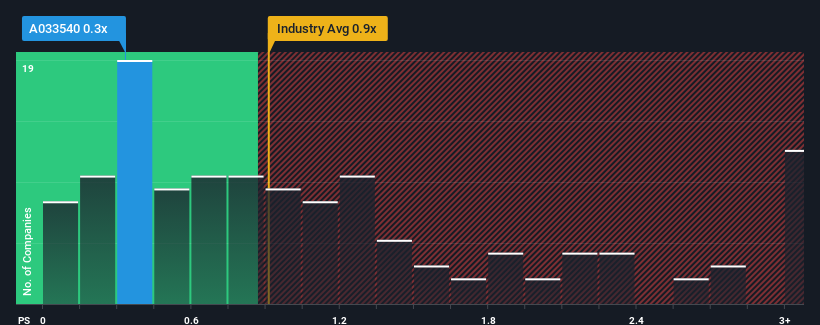

The (KOSDAQ:033540) price-to-sales ratio (or “P/S”) of 0.3x may seem like a fairly attractive investment opportunity considering that nearly half of the companies in the machinery industry in Korea have a P/S ratio of over 0.9x. However, the P/S might be low for a reason and further research is needed to determine if it is justified.

Check out our latest analysis for Paratech

How has Paratech developed recently?

Paratech’s recent revenue growth has to be described as satisfactory, if not spectacular. It could be that many are expecting the respectable revenue performance to slow down, which has depressed the price-to-earnings ratio. Those who bet on Paratech will hope that this does not happen so they can buy the stock at a lower price.

Although there are no analyst estimates for Paratech, take a look at these free Data-rich visualization to see how the company is performing in terms of profit, revenue and cash flow.

Do the sales forecasts match the low P/S ratio?

There is a fundamental assumption that a company must underperform the industry for P/S ratios like Paratech’s to be considered reasonable.

Looking back, last year saw a decent increase in sales for the company of 4.5%. The last three-year period also saw an excellent overall increase in sales of 123%, partly helped by short-term developments. So, first of all, we can say that the company has done an excellent job of increasing sales during this time.

Compared to the industry, growth of 31 percent is forecast for the next twelve months. Based on the latest medium-term annual sales figures, the company’s dynamics are quite similar.

Given this backdrop, it is odd that Paratech’s P/S is below that of most other companies. It may be that most investors are not convinced that the company can sustain recent growth rates.

What can we learn from Paratech’s P/S?

It’s not a good idea to use the price-to-sales ratio alone to decide whether to sell your stock, but it can be a useful guide to the company’s future prospects.

The fact that Paratech is currently trading at a low price-to-sales ratio relative to the industry is unexpected considering that its recent three-year growth is in line with broader industry forecasts. There could be some unnoticed threats to sales that prevent the price-to-sales ratio from matching the company’s performance. At a minimum, the risk of a price decline seems low if recent medium-term sales trends continue, but investors seem to believe that future sales could be subject to some volatility.

Before you take the next step, you should know about the 2 warning signs for Paratech that we uncovered.

Naturally, Profitable companies with a history of strong earnings growth are generally safer bets. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.