Many investors, especially inexperienced ones, often buy stocks in companies with a good history, even when those companies are losing money. But the reality is that if a company loses money every year for long enough, its investors usually bear their share of those losses. Loss-making companies can act like a sponge on capital – so investors should be careful not to throw good money after bad.

If this type of company is not your style, but you like companies that generate revenue and even profits, then you might be interested in Iwatani (TSE:8088). Although profit is not the only metric to consider when investing, it is worth identifying companies that can generate it consistently.

Check out our latest analysis on Iwatani

Iwatani’s earnings per share rise

If a company can grow its earnings per share (EPS) long enough, its share price should eventually follow. Therefore, it makes sense for experienced investors to pay close attention to earnings per share when analyzing investments. Impressively, Iwatani has been able to grow its earnings per share by 24% per year over the past three years. If the company can maintain this level of growth, we expect shareholders to be happy.

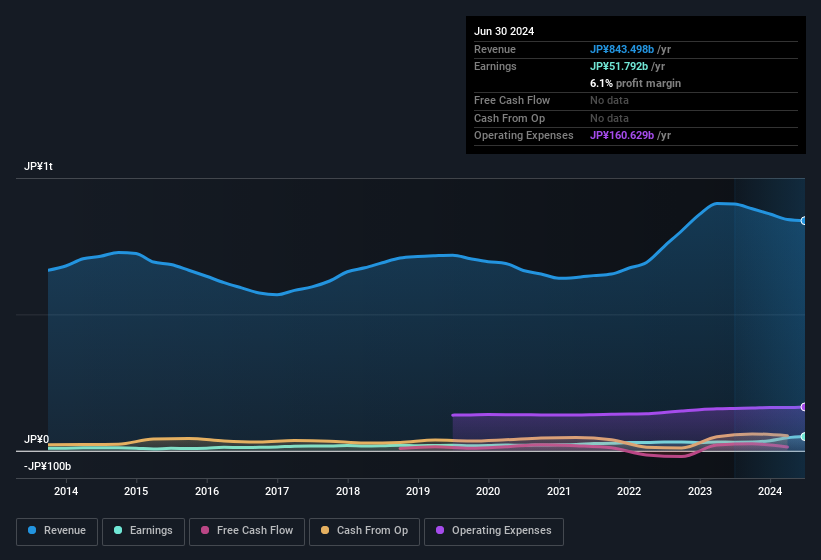

A careful look at revenue growth and earnings before interest and tax (EBIT) margins can help assess the sustainability of recent earnings growth. While Iwatani has been able to maintain its EBIT margins over the last year, revenue has been declining. While this may be a concern, investors should investigate the reasons behind it.

In the graphic below you can see how the company has grown profit and revenue over time. Click on the image to see more detailed information.

You don’t drive with your eyes in the rearview mirror, so you might be more interested in the free Report with analyst forecasts for Iwatani’s Future profits.

Are Iwatani insiders on the same page as all shareholders?

It should give investors a sense of security when they own shares in a company when insiders also own shares, creating a close alignment of interests. Therefore, it is good to see that Iwatani insiders have invested a significant amount of capital in the stock. In fact, they hold JP¥2.5 billion worth of shares. This sizeable investment should help increase the company’s long-term value. Even though that’s only about 0.5% of the company, it’s enough money to indicate alignment between company leaders and ordinary shareholders.

Is it worth keeping an eye on Iwatani?

There’s no denying that Iwatani has been growing its earnings per share at a very impressive rate. That’s attractive. That EPS growth rate is something the company can be proud of, and so it’s no surprise that insiders hold a sizable chunk of shares. Fast growth and confident insiders should be enough to warrant further research, so it seems like it’s a good stock to follow. Before you take the next step, you should know about the 1 warning sign for Iwatani that we uncovered.

While it may be worth investing in stocks without rising earnings and without insider buying, for investors who value these key metrics, we have compiled a carefully curated list of Japanese companies with promising growth potential and insider confidence.

Please note that the insider transactions discussed in this article are reportable transactions in the respective jurisdiction.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.