According to a recent analysis, Bitcoin (BTC) is in an unusual period of calm for it, but there are signs of an impending increase in volatility.

According to the latest weekly newspaper report According to blockchain analytics firm Glassnode, key indicators suggest the cryptocurrency market is experiencing a rare equilibrium – and that it may not last.

“Historically, periods of calm and relaxed market structure are short-lived and often precede expectations of increased volatility,” the report said.

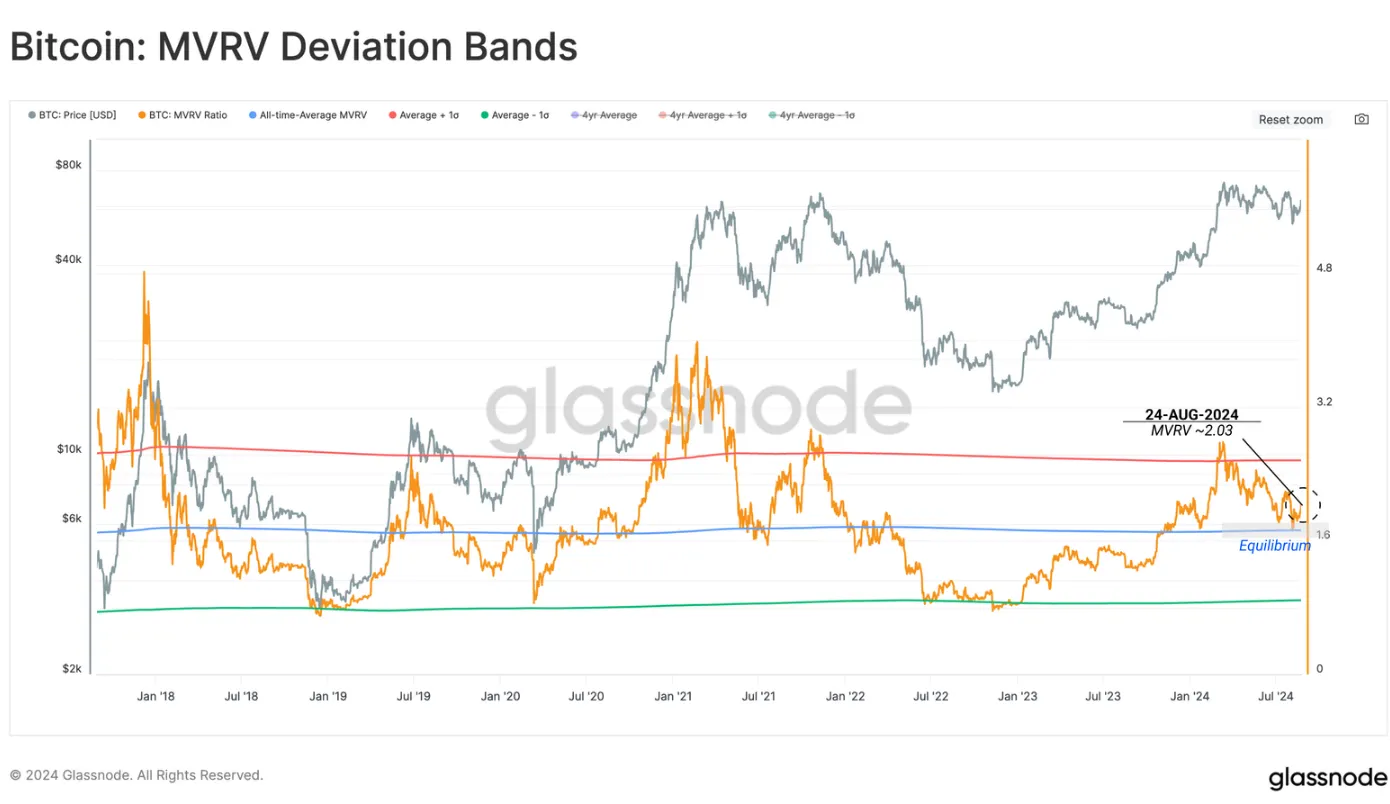

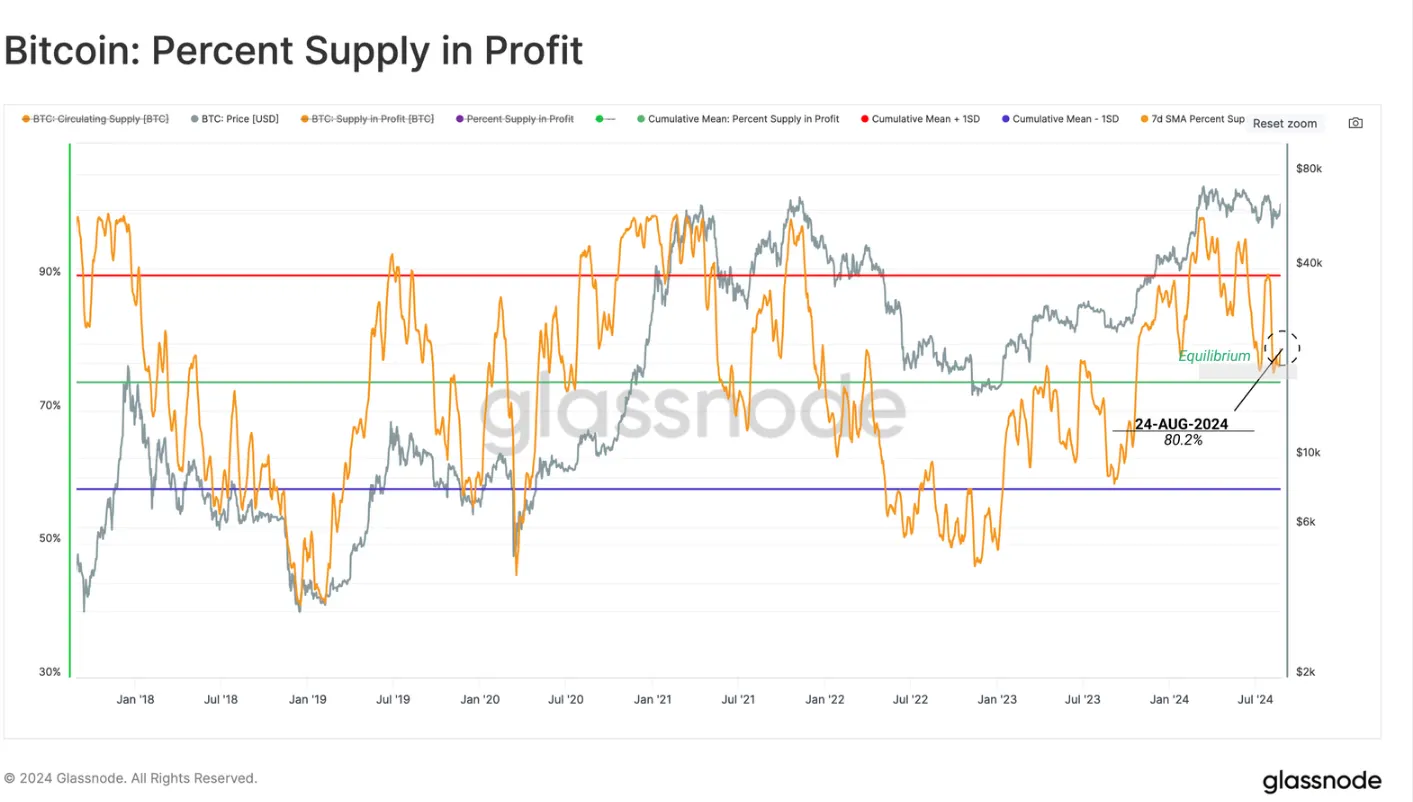

One of the most telling metrics highlighted in the report is the MVRV (Market Value to Realized Value) ratio. This indicator compares Bitcoins current market price to average price at which the coins were last moved, effectively measuring the average profit or loss of all Bitcoin holders.

“Over the past two weeks, the MVRV ratio has tested its all-time average of 1.72,” the report said. “This critical level has historically marked a transition point between a macroeconomic bull and bear market trend.”

In particular, an MVRV ratio above 1 indicates that the current market value exceeds the realized value, suggesting that the average holder is making a profit. Conversely, a ratio below 1 means that the average holder is making a loss. The current test of the 1.72 level is particularly significant following the excitement surrounding the launch of Bitcoin spot ETFs.

“This suggests that profitability for investors is essentially back in balance and that the excitement and enthusiasm following ETF launch has completely cooled down,” Glassnode said.

To add to the tension, the report notes a significant slowdown in Net capital flows into Bitcoin assetswith investors taking only marginal profits and losses. Glassnode points out that “89% of days have seen a larger inflow of capital than today, excluding loss-dominated bear markets.”

Further complicating the picture is that a significant portion of Bitcoin holdings held by short-term investors are close to transitioning to long-term holder status after being held for at least 155 days – a shift that could also impact market fluctuations in the near future.

On the derivatives market, Glassnode continues, speculation with perpetual swaps experience a complete reset. The ratio between price and volatility of net liquidation volume is approaching levels not seen since February 2022, indicating a significant decline in traders’ demand for leveraged positions.

“Normally this value returns to a neutral value. Levels near turning points such as a continuation of the trend or a reversal back to a declining trend at the macroeconomic level,” the report said.

Daily debriefing Newsletter

Start each day with the latest breaking news, plus original stories, a podcast, videos and more.