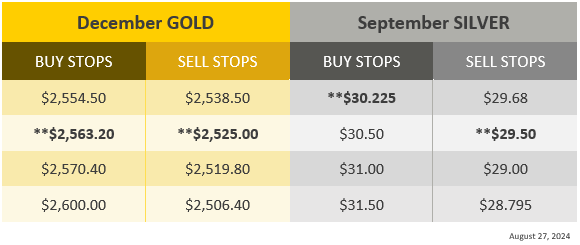

(Comment from Kitco) – Below are the likely price locations of today’s buy and sell stop orders for the active Comex gold and silver futures markets. The asterisks (**) indicate the most critical stop order placement level of the day (or likely the location where the largest concentration of stop orders will be placed that day).

Below is a detailed explanation of stop orders and why it can be beneficial for a trader to know in advance where they are likely to be.

Definition of stop orders

Stop orders can be used in trading markets for three purposes: First: To minimize a loss on a long or short position (protective stop). Second: To protect a profit on an existing long or short position (protective stop). Third: To open a new long or short position. A buy stop order is placed above the market price and a sell stop order is placed below the market price. Once the stop price is reached, the order is treated as a “market order” and executed at the best possible price.

Most stop orders are located and placed based on important technical support or resistance levels on the daily chart, the breach of which would significantly change the technical situation of the market in the short term.

If an active trader has a good idea in advance of where the buy and sell stops are, he can better estimate at what price level the buying or selling pressure will increase in that market.

The main benefit of using protective stops is that before you start a trade, you have a pretty good idea of where you will exit the trade if it is a losing trade. Once the trade becomes a winner and starts to make gains, you may want to use “trailing stops” where protective stops are adjusted to lock in a profit in case the market turns against your position.

Disclaimer: The views expressed in this article are those of the author and may not reflect the views of Kitco Metals Inc. The author has made every effort to ensure the accuracy of the information provided, however neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is for informational purposes only. It is not a solicitation for the exchange of commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article assume no responsibility for any loss and/or damage arising from the use of this publication.