Many investors, especially inexperienced ones, often buy stocks in companies with a good history, even when those companies are making losses. But as Peter Lynch in One step ahead on Wall Street“Long-term risky investments almost never pay off.” Loss-making companies are in a race against time to achieve financial sustainability, so investors in these companies may take more risk than necessary.

Although we are in the era of high-sky investing in technology stocks, many investors still follow a more traditional strategy. They buy shares of profitable companies such as Euronext (EPA:ENX). While this doesn’t necessarily mean the company is undervalued, the company’s profitability is enough to justify some appreciation – especially if it’s growing.

Check out our latest analysis for Euronext

How quickly does Euronext grow earnings per share?

If a company can grow its earnings per share (EPS) long enough, its share price should eventually follow. This makes EPS growth an attractive trait for any company. Euronext has been able to grow its earnings per share by 10% per year over three years. This growth rate is pretty good, assuming the company can sustain it.

It is often helpful to look at earnings before interest and tax (EBIT) margins and revenue growth to get another perspective on the quality of a company’s growth. Our analysis has shown that Euronext’s revenue from operational business has not reported all of its revenues for the last 12 months, so our analysis of margins may not accurately reflect the underlying business. Euronext shareholders can be pleased to know that EBIT margins have increased from 45% to 48% over the last 12 months and revenues are also on an upward trend. Both are great metrics to tick off for potential growth.

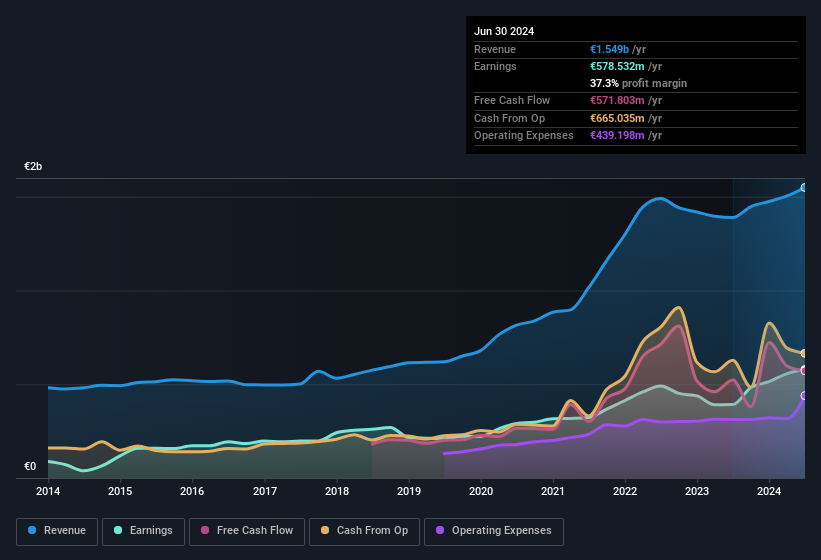

The chart below shows how the company’s profit and revenue have changed over time. Click on the chart to see the actual numbers.

Of course, the trick is to find stocks that have their best days in the future, not in the past. You can of course base your opinion on past performance, but you may also want to check out this interactive chart with professional analysts’ EPS forecasts for Euronext.

Are Euronext insiders on the same page as all shareholders?

Given the size of Euronext, we would not expect insiders to own a significant portion of the company. But we are reassured that they are investors in the company. In fact, they own €14 million worth of shares. This shows a significant stake and may indicate conviction in the business strategy. Although it is only 0.1% of the company, the value of this investment is enough to show that insiders have invested heavily in the company.

Is it worth keeping an eye on Euronext?

A key encouraging feature of Euronext is its growing earnings. For those expecting a little more, the high percentage of insider ownership increases our enthusiasm for this growth. The combination is definitely favored by investors, so you might want to keep the company on your watchlist. Before you get too excited, though, here’s what we discovered: 1 warning signal for Euronext that you should know.

While it may be worth investing in stocks without growing earnings and without insider buying, for investors who value these key metrics, we have compiled a carefully curated list of companies in FR with promising growth potential and insider confidence.

Please note that the insider transactions discussed in this article are reportable transactions in the respective jurisdiction.

Valuation is complex, but we are here to simplify it.

Find out if Euronext could be undervalued or overvalued with our detailed analysis, Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.