When we want to find a potential multi-bagger, there are often underlying trends that can provide clues. Ideally, a company will exhibit two trends: first, a growing return on the capital employed (ROCE) and secondly an increasing Crowd of the capital employed. This shows us that it is a compound interest machine that is able to continuously reinvest its profits in the company and generate higher returns. However, at first glance Bestechnic (Shanghai) (SHSE:688608) We’re not exactly thrilled about the yield trend, but let’s take a closer look.

Understanding Return on Capital Employed (ROCE)

For those who don’t know, ROCE is a measure of a company’s annual profit before taxes (its return) in relation to the capital employed in the company. The formula for this calculation at Bestechnic (Shanghai) is:

Return on capital = earnings before interest and taxes (EBIT) ÷ (total assets – current liabilities)

0.0036 = CNY 22 million ÷ (CNY 6.5 billion – CNY 357 million) (Based on the last twelve months to March 2024).

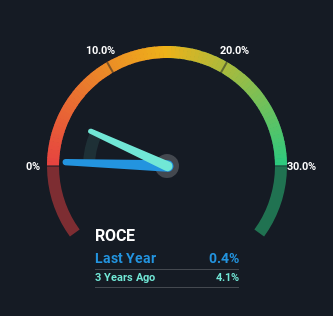

So, Bestechnic (Shanghai) has a ROCE of 0.4%. Ultimately, this is a low return and is below the industry average of 4.6% in the semiconductor industry.

Check out our latest analysis for Bestechnic (Shanghai).

In the chart above, we’ve compared Bestechnic (Shanghai)’s past ROCE with its past performance, but the future is arguably more important. If you want to know what analysts are forecasting for the future, you should check out our free analyst report for Bestechnic (Shanghai).

The trend of ROCE

On the surface, Bestechnic (Shanghai)’s ROCE trend does not inspire confidence. Around five years ago, ROCE was 6.2%, but since then it has fallen to 0.4%. However, given the increased revenues and assets deployed in the company, this could indicate that the company is investing in growth and the additional capital has led to a short-term reduction in ROCE. If these investments prove successful, this can be a very good sign for the stock’s long-term performance.

As a side note, Bestechnic (Shanghai) has done a good job of reducing its current liabilities to 5.5% of total assets, so we could attribute this in part to the decline in ROCE. In addition, it may reduce some aspects of business risk as the company’s suppliers or short-term creditors are now investing less in operations. Since the company is essentially funding more of its operations with its own money, one could argue that this has reduced the company’s efficiency in generating ROCE.

What we can learn from Bestechnic’s (Shanghai) ROCE

In summary, despite lower returns in the short term, we are encouraged to see Bestechnic (Shanghai) reinvesting in growth and generating higher revenues as a result. And there could be an opportunity here, with other metrics looking good too, as the stock has lost 48% over the past three years. So we think it would be worth taking a closer look at this stock as the trends look encouraging.

If you are still interested in Bestechnic (Shanghai), it is worth taking a look at our FREE intrinsic value approximation for 688608 to see if it is trading at an attractive price in other respects as well.

For those who like to invest in solid companies, look at this free List of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we are here to simplify it.

Find out if Bestechnic (Shanghai) could be undervalued or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.