Fujifilm Insulation Co., Ltd. (TSE:3944) The recent weak earnings report did not trigger much price movement. Our analysis suggests that investors should pay attention to other underlying weaknesses in the numbers in addition to weak earnings numbers.

Check out our latest analysis for Furubayashi ShikoLtd

The impact of unusual items on profit

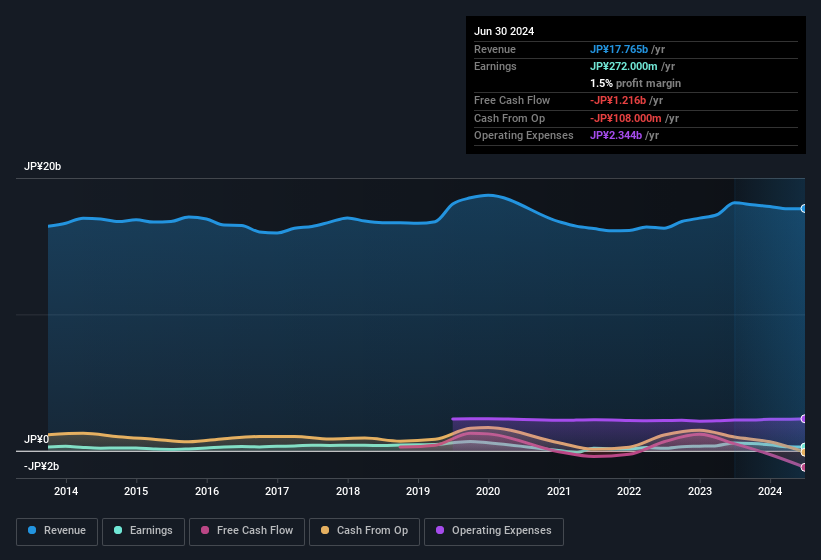

To properly understand Furubayashi ShikoLtd’s earnings numbers, we need to take into account the JP¥149 million profit that was due to unusual items. While we are happy to see earnings increases, we are a bit more cautious when unusual items have made a major contribution. When we analyzed the numbers of thousands of listed companies, we found that an increase due to unusual items in a given year is often not repeated next year. Which is hardly surprising given the name. We can see that Furubayashi ShikoLtd’s positive unusual items were quite significant relative to its profit in the year to June 2024. All else remaining unchanged, this would likely result in statutory profit not being a good indicator of underlying earnings power.

Note: We always recommend investors to check balance sheet strength. Click here to access our balance sheet analysis of Furubayashi ShikoLtd.

Our assessment of Furubayashi ShikoLtd’s earnings development

As mentioned, Furubayashi ShikoLtd’s big boost from unusual items won’t last indefinitely, so its statutory profit is unlikely to be a good indicator of its underlying profitability. As such, we believe it’s quite possible that Furubayashi ShikoLtd’s underlying earnings power is lower than its statutory profit. But at least holders can take some comfort from the 51% annual earnings per share growth over the past three years. Ultimately, it’s important to consider more than just the factors above if you want to properly understand the company. With that in mind, it’s important to be aware of the risks involved if you want to conduct further analysis of the company. Note that Furubayashi ShikoLtd 5 warning signals in our investment analysis and one of them is causing some concern…

This note only examined a single factor that can shed light on the nature of Furubayashi ShikoLtd.’s earnings. However, there are many other ways to form an opinion about a company. For example, many people consider a high return on equity to indicate a favorable business situation, while others like to “follow the money” and look for stocks that insiders are buying. Although this may require a little research, you may find free Collection of companies with high return on equity or this list of stocks with significant insider holdings may prove useful.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.