The excitement of investing in a company that can turn its fortunes around is a big draw for some speculators, so even companies that have no revenue, no profit, and a long track record can find investors. Sometimes such stories can cloud investors’ minds and cause them to invest based on their emotions rather than good company fundamentals. A loss-making company has yet to prove itself with profits, and at some point the inflow of outside capital may dry up.

If this type of company is not your style, but you like companies that generate revenue and even profits, then you might be interested in Hexing Electrical Ltd. (SHSE:603556). Even if this company is fairly valued by the market, investors would agree that Hexing Electrical Ltd. still has the opportunity to increase value for shareholders over the long term by generating consistent earnings.

Check out our latest analysis for Hexing ElectricalLtd

Hexing Electrical Ltd. earnings per share increase

If you believe that markets are even remotely efficient, then over the long term you would expect a company’s share price to follow its earnings per share (EPS). This means that EPS growth is viewed as a real positive by most successful long-term investors. It is certainly nice to see that Hexing Electrical Ltd has managed to grow EPS by 30% per year over three years. If the company can sustain this growth, we expect shareholders to be happy.

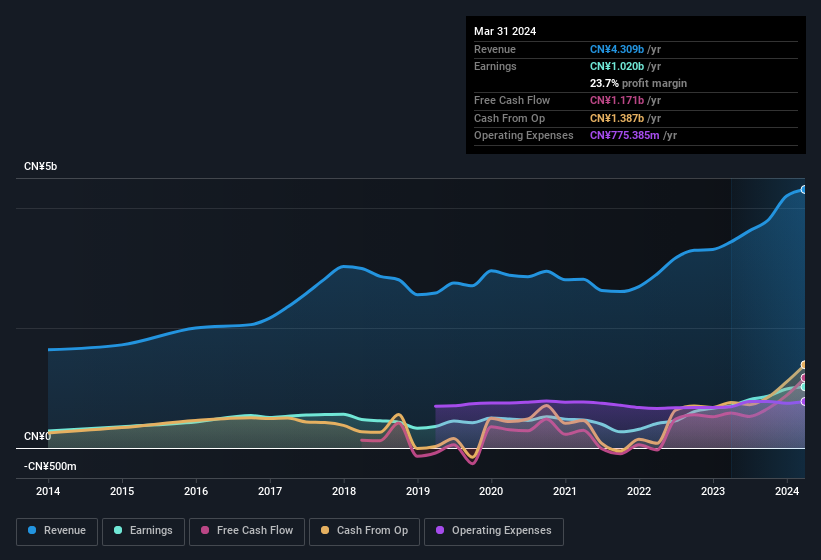

One way to check a company’s growth is to look at how its revenue and earnings before interest and tax (EBIT) are changing. The good news is that Hexing Electrical Ltd. is growing its revenue and its EBIT margins have improved by 4.6 percentage points to 23% over the last year. Both are great metrics to check off for potential growth.

In the following graphic you can see the company’s sales and profit development. Click on the image to get more details.

Of course, the trick is to find stocks that have their best days in the future rather than the past. You can of course base your opinion on past performance, but you may also want to check out this interactive chart with professional analysts’ EPS forecasts for Hexing Electrical Ltd.

Are the insiders of Hexing Electrical Ltd. on the same page as all shareholders?

It should give investors a sense of security when they own shares in a company when insiders also own shares, creating a close alignment of their interests. Supporters of Hexing Electrical Ltd. will take comfort in the fact that insiders have a significant amount of capital, aligning their interests with those of the wider shareholder group. We note that their impressive stake in the company is worth CNY2.4 billion. Holders should find this level of insider ownership very encouraging, as it ensures that the company’s executives will also succeed or fail with the stock.

Should you add Hexing ElectricalLtd to your watchlist?

For growth investors, Hexing Electrical Ltd.’s pure earnings growth rate is a bright spot in the night. Moreover, the high level of insider ownership is impressive and suggests that management values EPS growth and has confidence in Hexing Electrical Ltd.’s continued strength. The growth and insider confidence are viewed positively and it is therefore worth taking a closer look to see the stock’s true value. However, it is still necessary to consider the ever-present specter of investment risk. We have identified 1 warning signal with Hexing Electrical Ltd., and understanding this should be part of your investment process.

While it may be worth investing in stocks without rising earnings and without insider buying, for investors who value these key metrics, we have compiled a carefully curated list of Chinese companies with promising growth potential and insider confidence.

Please note that the insider transactions discussed in this article are reportable transactions in the respective jurisdiction.

Valuation is complex, but we are here to simplify it.

Discover if Hexing ElectricalLtd could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.