Last week’s earnings announcement from Biogened SA (WSE:BGD) has been disappointing for investors despite strong headlines. We’ve done some digging and found some troubling underlying issues.

Check out our latest analysis for Biogened

How do unusual items affect profits?

For anyone looking to understand Biogened’s profit beyond the statutory numbers, it’s important to know that statutory profit over the last twelve months came from extraordinary items worth PLN 691,000. While we’re happy to see profit increases, we’re a bit more cautious when extraordinary items have made a big contribution. When we analyzed the vast majority of listed companies worldwide, we found that significant extraordinary items are often not repeated. And that’s exactly what accounting terminology implies. If that contribution is not repeated at Biogened, we would expect a decline in profits in the current year, all things being equal.

Note: We always recommend investors check balance sheet strength. Click here to access our balance sheet analysis of Biogened.

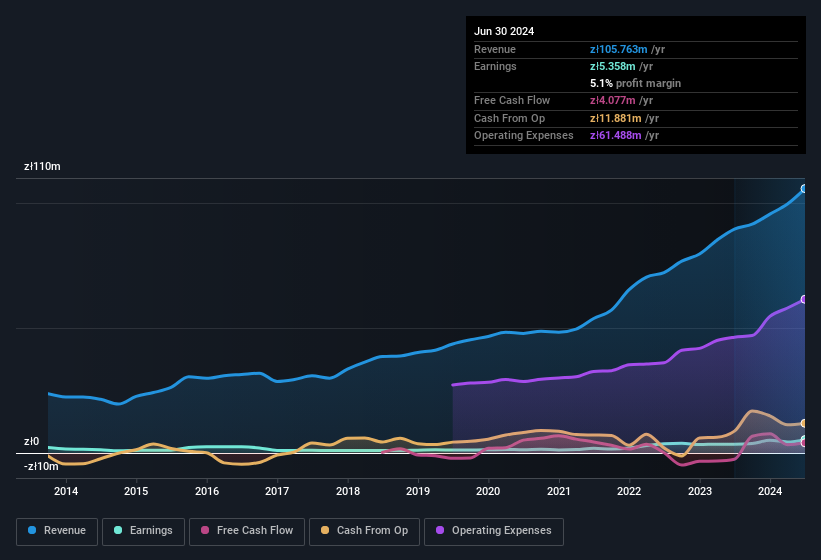

Our assessment of Biogened’s earnings development

One could argue that Biogened’s statutory earnings were distorted by unusual items that boosted earnings. For this reason, we believe Biogened’s statutory earnings could be better than its underlying earnings power. But the positive side is that its earnings per share have grown extremely impressively over the past three years. Ultimately, it’s important to consider more than just the factors mentioned above if you want to properly understand the company. So while the quality of earnings is important, it’s equally important to consider the risks Biogened is currently facing. For example, Biogened has 3 warning signs (and 1 that is possibly serious) that we think you should know about.

This article has only examined a single factor that can shed light on the nature of Biogened’s earnings. But there is always more to discover if you can focus on the details. For example, many people consider a high return on equity to indicate a favorable business situation, while others prefer to “follow the money” and look for stocks that insiders are buying. You might want to check this out. free Collection of companies with high return on equity or this list of stocks with high insider ownership.

Valuation is complex, but we are here to simplify it.

Find out if Biogened is undervalued or overvalued with our detailed analysis. Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.