The market reacted with a shrug Zhejiang Tongxing Technology CO., Ltd (SZSE:301252) solid earnings report. We did some research and believe investors may be concerned about some underlying factors in the report.

Check out our latest analysis for Zhejiang Tongxing Technology

Zhejiang Tongxing Technology’s earnings in detail

As finance nerds already know, Accrual ratio from cash flow is an important measure to assess how well a company’s free cash flow (FCF) matches its earnings. To get the accrual ratio, we first subtract FCF from earnings for a period and then divide that number by the average funds from operations for the period. This ratio indicates how much of a company’s earnings are not covered by free cash flow.

Consequently, a negative accrual ratio is positive for the company and a positive accrual ratio is negative. This is not to say that we should be concerned about a positive accrual ratio, but it is worth noting when the accrual ratio is quite high. In particular, there is some academic evidence suggesting that a high accrual ratio is generally a bad sign for short-term earnings.

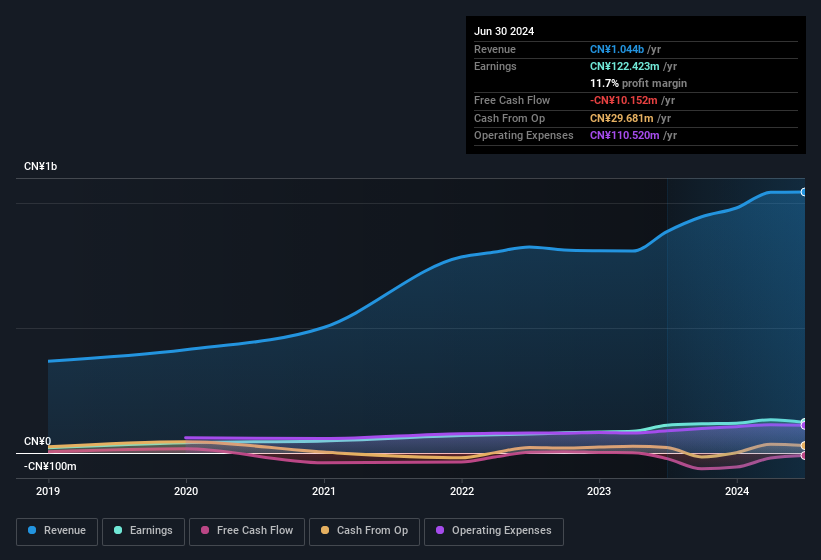

Zhejiang Tongxing Technology has an accrual ratio of 0.22 for the year to June 2024. Therefore, we know that its free cash flow was significantly lower than its statutory profit, which is hardly a good thing. In fact, over the last twelve months, it had Negative free cash flow, with an outflow of CN¥10 million despite the aforementioned profit of CN¥122.4 million. Given the negative free cash flow last year, some shareholders may question whether the cash burn of CN¥10 million this year is high risk.

Note: We always recommend investors to check balance sheet strength. Click here to access our balance sheet analysis of Zhejiang Tongxing Technology.

Our assessment of Zhejiang Tongxing Technology’s earnings development

Zhejiang Tongxing Technology hasn’t converted much of its profit into free cash flow over the last year, which some investors might consider rather suboptimal. For this reason, we believe Zhejiang Tongxing Technology’s statutory profits could be better than its underlying earnings power. But at least holders can take some comfort from its 39% annual EPS growth over the past three years. Of course, we’ve only scratched the surface when analyzing earnings; you might also consider margins, forecast growth and return on capital, among other things. If you want to dive deeper into Zhejiang Tongxing Technology, you should also examine what risks the company is currently facing. Case in point: We discovered 3 warning signs for Zhejiang Tongxing Technology You should be on your guard and two of these bad guys cannot be ignored.

Today we’ve focused on a single data point to better understand the nature of Zhejiang Tongxing Technology’s earnings. But there are many other ways to form an opinion about a company. For example, many people consider a high return on equity to indicate a favorable business situation, while others prefer to “follow the money” and look for stocks that insiders are buying. You might want to check this out. free Collection of companies with high return on equity or this list of stocks with high insider ownership.

Valuation is complex, but we are here to simplify it.

Find out if Zhejiang Tongxing Technology could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.