The latest results from Arizon RFID Technology (Cayman) Co., Ltd. (TWSE:6863) were solid, but the stock didn’t move as much as expected. However, the statutory earnings number doesn’t tell the whole story, and we’ve found some factors that could be of concern to shareholders.

Check out our latest analysis for Arizon RFID Technology (Cayman)

Considering Arizon RFID Technology (Cayman)’s cash flow versus earnings

Many investors have never heard of the Accrual ratio from cash flowbut it is actually a useful measure of how well a company’s profit is covered by free cash flow (FCF) during a given period. To get the accrual ratio, we first subtract FCF from profit for a period and then divide that number by average funds from operations for the period. This ratio tells us how much of a company’s profit is not covered by free cash flow.

This means that a negative accrual ratio is a good thing because it shows that the company is generating more free cash flow than its earnings would suggest. While it is not a problem to have a positive accrual ratio, which indicates some level of non-cash profits, a high accrual ratio is arguably a bad thing because it indicates that there is no cash flow to match accounting profits. This is because some academic studies have pointed out that high accrual ratios tend to lead to lower earnings or lower earnings growth.

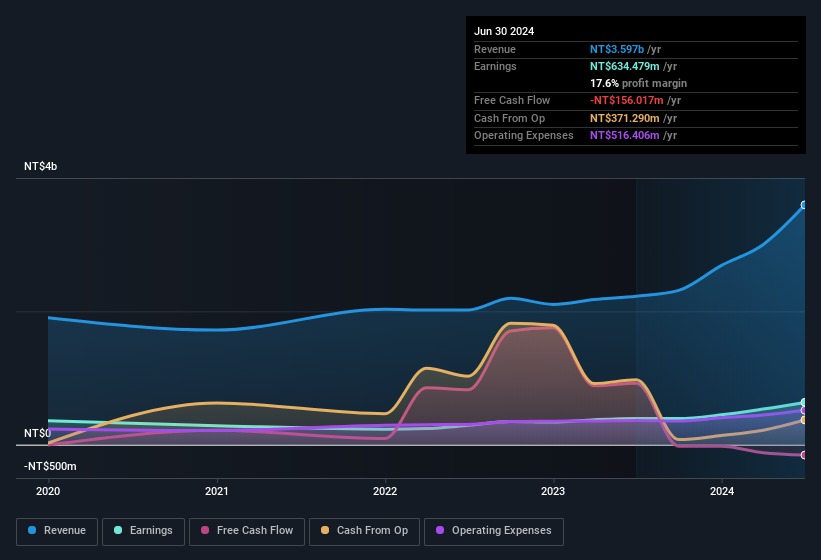

For the year to June 2024, Arizon RFID Technology (Cayman) had an accrual ratio of 0.22. Therefore, we know that its free cash flow was significantly lower than its statutory profit, which is hardly a good thing. In fact, over the last twelve months, it had Negative free cash flow, with an outflow of NT$156 million despite the aforementioned profit of NT$634.5 million. However, we saw that FCF was NT$923 million a year ago, so Arizon RFID Technology (Cayman) has at least been able to generate positive FCF in the past. The good news for shareholders is that Arizon RFID Technology (Cayman)’s accrual ratio was much better last year, so the poor reading this year could simply be due to a short-term mismatch between profit and FCF. As a result, some shareholders may be hoping for stronger cash conversion in the current year.

You may be wondering what analysts are predicting in terms of future profitability. Fortunately, you can click here to see an interactive chart depicting future profitability based on their estimates.

Our assessment of Arizon RFID Technology (Cayman)’s earnings development

Arizon RFID Technology (Cayman)’s accrual ratio for the last twelve months shows that cash conversion is less than ideal, which negatively impacts our view of its earnings. For this reason, we believe Arizon RFID Technology (Cayman)’s statutory profits could be better than its underlying earnings power. However, the good news is that its EPS growth over the last three years has been very impressive. Of course, we have only scratched the surface when analyzing its earnings; one could also consider margins, forecast growth and return on capital, among other things. With this in mind, it is important that you learn about the risks involved if you want to analyze the company in more detail. To this end, you should read about the 2 warning signs we have spotted at Arizon RFID Technology (Cayman) (including 1 that is a bit concerning).

Today we’ve focused on a single data point to better understand the nature of Arizon RFID Technology (Cayman)’s earnings. But there are many other ways to form an opinion about a company. Some people consider a high return on equity to be a good sign of a high-quality company. Although this may require a little research, you may find that free Collection of companies with high return on equity or this list of stocks with significant insider holdings may prove useful.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.