If we want to avoid a declining business, what trends can warn us in advance? Usually we see the trend of both return on capital employed (ROCE) falls, and this is usually accompanied by a falling Crowd of the capital employed. Basically, the company earns less from its investments and it also reduces its balance sheet total. After looking at the trends within VarioSecure (TSE:4494) we were not too hopeful.

Understanding Return on Capital Employed (ROCE)

For those who don’t know what ROCE is, it measures the amount of pre-tax profit a company can generate with the capital employed in its business. To calculate this metric for Vario Secure, the formula is:

Return on capital = earnings before interest and taxes (EBIT) ÷ (total assets – current liabilities)

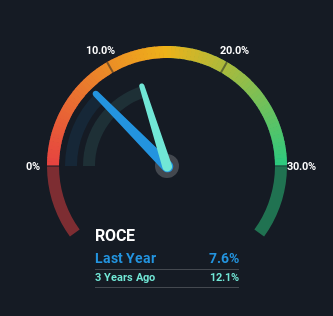

0.076 = JP¥527 million ÷ (JP¥7.6 billion – JP¥676 million) (Based on the last twelve months to May 2024).

Therefore, Vario Secure has a ROCE of 7.6%. Ultimately, this is a low return and is below the IT industry average of 15%.

Check out our latest analysis for Vario Secure

While the past is not representative of the future, it can be useful to know a company’s historical performance, which is why we have this chart above. If you want to see how Vario Secure has performed in other metrics in the past, you can see that here. free Graph of Vario Secure’s past earnings, revenue and cash flow.

What the ROCE trend can tell us

We are a little concerned about the evolution of returns on capital at Vario Secure. About four years ago, returns on capital were 13%, but as we saw above, they are now significantly lower. And in terms of capital employed, the company is using about the same amount of capital as it did then. This combination may indicate a mature company that still has areas to deploy capital, but the returns achieved may not be as high due to new competition or lower margins. If these trends continue, we do not expect Vario Secure to become a multibagger.

What we can learn from Vario Secure’s ROCE

All in all, the lower returns on the same capital employed are not exactly signs of a compounding machine. Investors have not taken these developments well, with the stock down 44% from where it was three years ago. Unless these metrics move in a more positive direction, we will look elsewhere.

One final note: You should inform yourself about the 2 warning signs we discovered with Vario Secure (including 1 that cannot be ignored).

For those who like to invest in solid companies, look at this free List of companies with solid balance sheets and high returns on equity.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.