- Cardano’s market capitalization has plummeted by more than 50% since March after the company lost its place in the top 10 largest cryptocurrencies.

- Investors who have purchased ADA in the last two years have suffered an average loss of 26%.

- Long-term ADA holders may be capitulating as the number of daily and weekly active addresses has reached its lowest level since 2020.

- A daily candlestick close above USD 0.457 would invalidate the pessimistic thesis.

Cardano (ADA) slipped out of the top 10 cryptocurrencies by market cap on Monday after several of its on-chain metrics gave a bearish signal.

ADA risk continues to decline after slipping out of the top 10

ADA fell out of the top 10 cryptocurrencies by market cap for the first time in four years on Monday, according to data from CoinGecko.

ADA has largely underperformed compared to other altcoins in the current cycle, considering its price has been declining for five months since mid-March. During the same period, its market cap has plummeted by 56%, falling from $27.33 billion on March 12 to ~$12 billion on Monday. ADA’s year-to-date price performance also shows that investors have seen their holdings lose 43% in value.

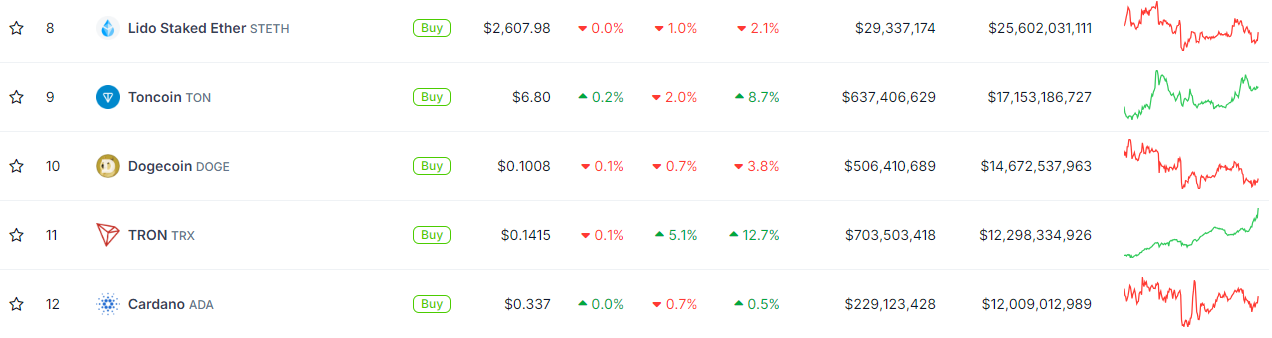

Top cryptos by market capitalization

From the perspective of the IntoTheBlock Global In/Out of the Money, it is evident that most ADA holders have suffered large unrealized losses. Global In/Out of the Money measures the average profit and loss of all coins and addresses. An address or coin is out of the money when the current price is below its average cost price, and vice versa when it is in the money.

ADA’s In/Out of the Money metric shows that over 78% of addresses and 68% of coins are out of the money, with the largest accumulation zone between $0.4 and $0.6.

Santiment’s 365-day MVRV (Market Value to Realized Value), which measures the average performance of all addresses that purchased ADA in the past year, shows that investors in this category are suffering an average loss of 26% – the same as their 2-year MVRV.

%20(22.25.36,%2019%20Aug,%202024)-638597044208240739.png)

ADA 365-day resting circulation and MVRV

ADA’s 365-day dormant circulation value, which measures the movement of coins that have not left an address in the past year, saw a sharp increase on Monday to 719.12 million ADA – the highest level since 2022. A similar increase can also be seen in the 180-day dormant circulation value. This suggests that long-term holders may be selling their coins, and ADA’s price has often declined when these metrics see an increase.

In addition, Cardano’s daily and weekly active addresses fell to 19,669 and 112,250, respectively, levels last seen in 2020.

%20(22.25.54,%2019%20Aug,%202024)-638597044866382115.png)

Daily and weekly active addresses of the ADA

The summary of these on-chain metrics suggests that investors may be highly bearish on ADA.

On the technical analysis side, the Awesome Oscillator recorded a bearish undercurrent on Thursday after a red bar accompanied two consecutive green bars. Although the move indicates a downward reversal, prices have been largely sideways since then. A break of the support line at around $0.275 would reinforce the bearish view.

ADA/USDT daily chart

On the upside, ADA is facing resistance at the 200-day, 100-day, and 50-day simple moving averages (SMA). A daily candlestick close above the resistance at $0.457 would invalidate the bearish thesis.