Over the past 7 days, the South Korean market is up 4.1%, driven by 8.2% gains in information technology. Over the past year, it is up 5.1%. With earnings expected to grow 28% annually, identifying high-growth technology stocks that fit these robust market conditions may be critical for investors looking to capitalize on this momentum.

The 10 fastest growing technology companies in South Korea

|

name |

Sales growth |

Profit growth |

Growth assessment |

|---|---|---|---|

|

ALTEOGEN |

48.67% |

72.95% |

★★★★★★ |

|

IMLtd |

20.76% |

106.30% |

★★★★★★ |

|

Bionier |

22.49% |

89.69% |

★★★★★★ |

|

NEXON Games |

31.70% |

66.31% |

★★★★★★ |

|

Seojin System Ltd |

34.20% |

58.67% |

★★★★★★ |

|

EuBiologics |

28.05% |

93.39% |

★★★★★★ |

|

Dev sisters |

26.11% |

65.92% |

★★★★★★ |

|

simons |

24.29% |

55.45% |

★★★★★★ |

|

Parking systems |

22.50% |

37.52% |

★★★★★★ |

|

Urinary tract infection |

103.56% |

122.67% |

★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

We’ll look at some of the best tips from our screener tool.

Simply Wall St Growth Rating: ★★★★☆☆

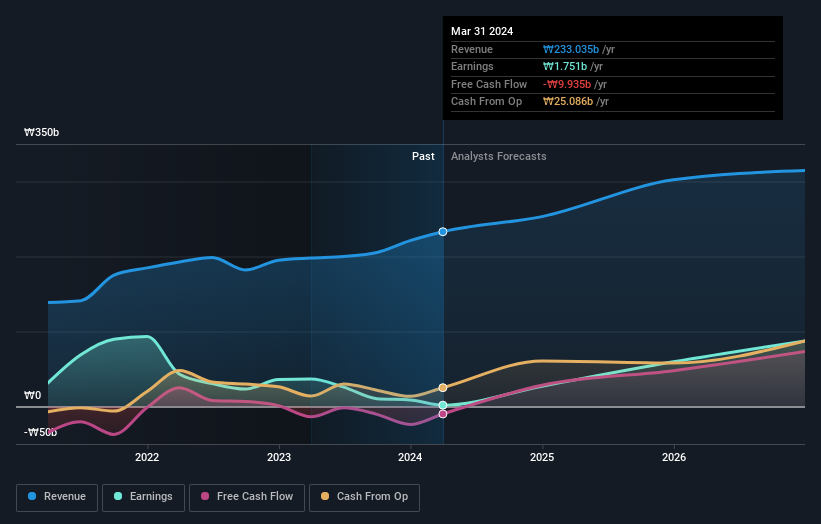

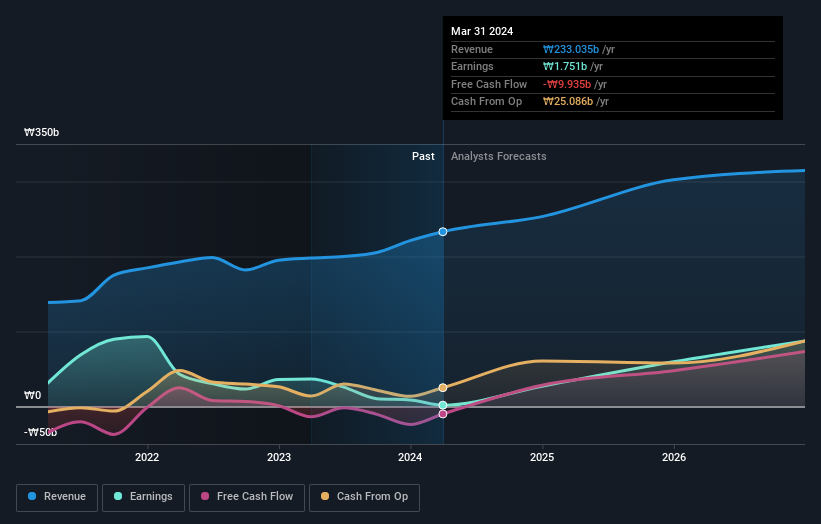

Overview: Medy-Tox Inc. is a biopharmaceutical company based in South Korea with a market capitalization of ₩1.38 billion.

Operations: The company’s revenue is primarily ₩233.03 billion from the biotechnology sector.

Medy-Tox’s R&D spending underscores its commitment to innovation, with ₩29.4 billion allocated last year, representing a significant 11.3% of revenue. Despite a volatile share price and lower profit margins of 0.8%, the company is poised for significant growth. Profits are expected to grow 60.7% annually over the next three years, outpacing the Korean market average of 28.4%. This focus on biopharmaceutical advances puts Medy-Tox in a favorable position within South Korea’s competitive technology landscape.

Simply Wall St Growth Rating: ★★★★☆☆

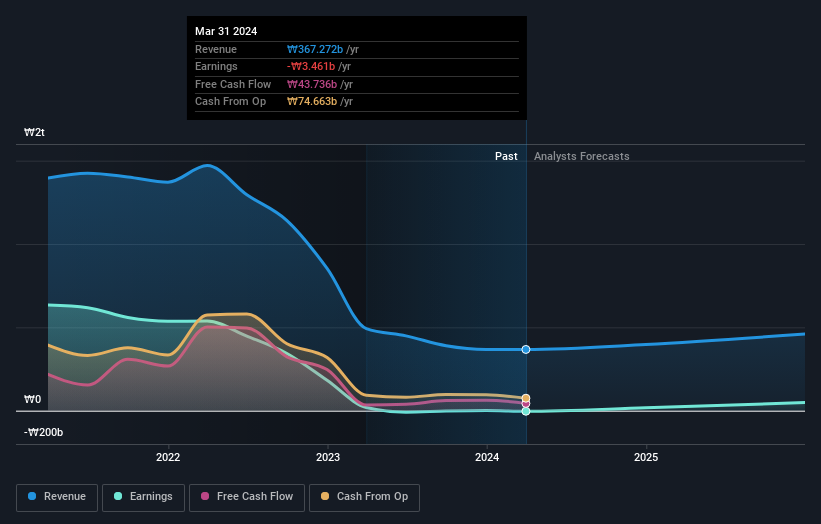

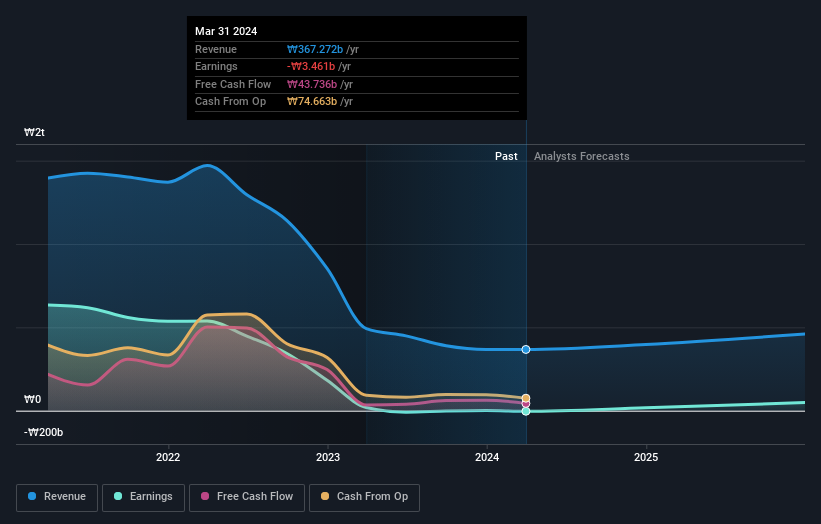

Overview: Seegene, Inc. manufactures and distributes molecular diagnostic products worldwide. The company has a market capitalization of Rp 1.59 trillion.

Operations: The company generates revenue of ₩367.27 billion mainly from the sale of diagnostic kits and devices.

Seegene’s focus on innovation is evident in its robust R&D spending, which totaled ₩29.4 billion last year and accounted for 11.3% of revenue. Despite a volatile share price over the past three months and current unprofitability, an impressive annual earnings growth of 62.6% is forecast for the next three years, indicating strong potential for future profitability. The recent extension of its share repurchase plan until July 2025 underscores Seegene’s commitment to increasing shareholder value in South Korea’s competitive technology landscape.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pearl Abyss Corp. is engaged in the development of gaming software and has a market capitalization of ₩2.73 trillion.

Operations: Pearl Abyss Corp.’s revenue is mainly from the sale of games and amounts to ₩325.80 billion. The company focuses on developing software for games, which contributes significantly to its financial performance.

Pearl Abyss, known for its gaming innovations, is expected to report revenue growth of 23.2% per year, outperforming the South Korean market at 10.7%. Their earnings are expected to grow 58.1% per year, driven by recent profitability and strategic expansion in the entertainment sector. The company’s R&D expenses totaled ₩29.6 billion last year, underscoring their commitment to innovation and creating high-quality content. Recent earnings calls indicate robust performance, with significant one-time gains positively impacting financial results.

Turning ideas into action

Curious about other options?

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include KOSDAQ:A086900, KOSDAQ:A096530 and KOSDAQ:A263750.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]