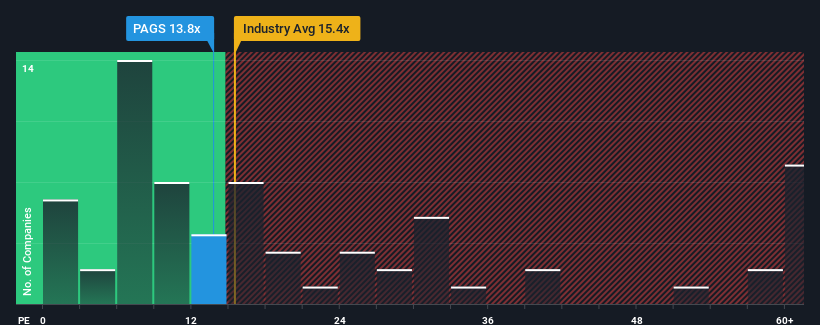

PagSeguro Digital Ltd. (NYSE:PAGS) price-to-earnings (or “P/E”) ratio of 13.8 might make it look like a buy right now, compared to the market in the United States, where about half of the companies have P/E ratios above 18x, and even P/E ratios above 33x are quite common. Still, we would have to dig a little deeper to determine if there is a rational basis for the reduced P/E ratio.

With earnings growth in positive territory compared to the declining earnings of most other companies, PagSeguro Digital has performed quite well recently. It could be that many expect the strong earnings performance to fade significantly, perhaps more than the market that has been pushing down the P/E ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for PagSeguro Digital

If you want to know what analysts are predicting for the future, you should check out our free Report on PagSeguro Digital.

What do growth metrics tell us about the low P/E ratio?

A P/E ratio as low as PagSeguro Digital’s would only be truly comfortable if the company’s growth lagged behind the market growth.

If we look at the earnings growth over the last year, the company has seen a fantastic increase of 18%. The strong recent performance means that it has also been able to achieve a total earnings increase of 51% over the last three years. So, first of all, we can say that the company has done an excellent job of growing its earnings during this time.

According to the twelve analysts who cover the company, earnings per share are expected to grow 13% per year over the next three years. With the market only expecting a 10% annual increase, the company is poised for a stronger result.

Given this background, it is strange that PagSeguro Digital’s P/E ratio is below that of most other companies. It seems as though most investors are not at all convinced that the company can meet future growth expectations.

The conclusion on PagSeguro Digital’s P/E ratio

In our opinion, the price-earnings ratio is not primarily used as a valuation tool, but rather to assess current investor sentiment and future expectations.

We found that PagSeguro Digital is currently trading at a significantly lower P/E than expected because its forecast growth is higher than the overall market. When we see a strong earnings forecast with above-market growth, we believe that potential risks could put significant pressure on the P/E. At a minimum, price risks appear to be very low, but investors seem to believe that future earnings could be very volatile.

We don’t want to spoil the fun too much, but we also found 1 warning sign for PagSeguro Digital that you need to consider.

You may find a better investment than PagSeguro Digital. If you want a selection of possible candidates, check out free List of interesting companies that trade at a low P/E ratio (but have proven that they can grow their earnings).

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.